Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 7,953 million (4.59 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar but gained against the Euro and the Sterling Pound to exchange at Ksh 118.27, Ksh 118.63 and Ksh 140.31 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 4.54% | 0.17% |

| Euro | -7.39% | -1.70% |

| Sterling Pound | -7.89% | -0.64% |

Liquidity

Liquidity in the money markets eased, partly reflecting government payments which offset tax remittances. Open market operations remained active. Diaspora remittances for the month of May stood at $326.1M representing a 6.6% and a -4.0% change year on year and month on month respectively.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.83% | 5.56% |

| Interbank volume (billion) | 20.59 | 29.20 |

| Commercial banks’ excess reserves (billion) | 31.00 | 27.70 |

Fixed Income

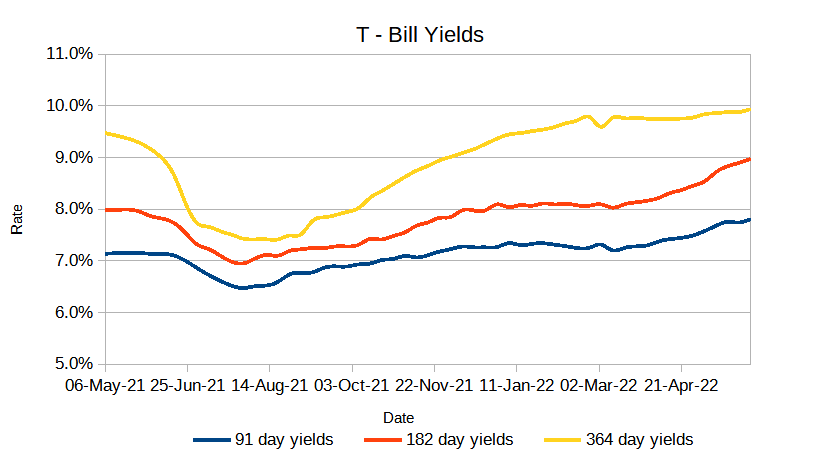

T-Bills

T-Bills were over-subscribed during the week with an increase in the overall subscription rate from 102.46% recorded in the previous week to 105.77%. The 91-day T-Bill got the highest subscription rate at 329.8% while the 364-day T-Bill and 182-day T-Bill had a subscription rate of 71.1% and 50.9% respectively. The acceptance rate increased by 1.33% to close the week at 99.77%.

T-Bonds

The bonds market had a lower demand for the week’s bond offers. Bonds turnover decreased by 44.03% from 12.76B in the previous week to 7.14B. Total bond deals decreased by 16.45%.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola and Ghana rose. Yields on Kenya’s Eurobonds generally increased by 234 basis points compared to the previous week, 2.68% and 11.19% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 17.23% | 4.70% | 4.20% |

| 2018 10-Year Issue | 10.82% | 1.98% | 1.59% |

| 2018 30-Year Issue | 7.89% | 2.23% | 1.95% |

| 2019 7-Year Issue | 13.87% | 3.34% | 2.87% |

| 2019 12-Year Issue | 8.58% | 1.48% | 1.25% |

| 2021 12-Year Issue | 8.76% | 2.37% | 2.20% |

Equities

NASI, and NSE 25 increased by 5.13% and 1.53% respectively while NSE 20 decreased by 0.56% compared to last week bringing the year to date performance to -14.82%, -14.44% and -12.11% respectively. The market capitalization increased by 5.14% from the week to close at 2.218 trillion recording a year to date decline of 14.77%. The performance was driven by gains recorded by large-cap stocks. Top gains were recorded in Safaricom which increased by 11.52%.

The Banking sector had shares worth Kshs 604M transacted which accounted for 46.27% of the week’s traded value, Manufacturing & Allied sector had shares worth 24.6M transacted which represented 1.89% and Safaricom, with shares worth Kshs 639M transacted represented 48.99% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Limuru Tea | 31.25% | 31.25% |

| Olympia Capital | 42.11% | 20.00% |

| NBV | -32.39% | 12.61% |

| Safaricom | -17.56% | 11.52% |

| Sameer Africa | 40.35% | 9.29% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | 12.62% | -12.86% |

| Standard | -12.92% | -10.94% |

| Stanbic | 3.45% | -9.09% |

| HF Group | -9.21% | -7.51% |

| Home Afrika | -5.00% | -7.32% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.12 | 1.04 | -50.93% |

| Derivatives Contracts | 36 | 22 | -38.89% |

| I-REIT Turnover | 0.16 | 0.31 | 91.43% |

| I-REIT Deals | 29 | 48 | 65.52% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -19.46% | -0.93% |

| Dow Jones Industrial Average (DJI) | -14.48% | -0.16% |

| FTSE 100 (FTSE) | -4.61% | -0.52% |

| STOXX Europe 600 | -15.55% | -0.80% |

| Shanghai Composite (SSEC) | -11.13% | -3.81% |

| MSCI Emerging Markets | -22.02% | -3.77% |

| MSCI World Index | -20.76% | -1.34% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -20.92% | -1.23% |

| JSE All Share | -12.11% | -5.16% |

| NSE All Share (NGSE) | 21.36% | 1.28% |

| DSEI (Tanzania) | -1.18% | -0.82% |

| ALSIUG (Uganda) | -11.80% | 0.99% |

U.S stocks closed the week higher despite shedding earlier during the week on fears of inflation. This comes as gains in the Financials, Healthcare and Consumer Services sectors led shares higher. U.S. stocks jumped as stronger than expected retail sales data put aside fears about an economic downturn. Retail sales in June rose 1% in June from the prior month, and May’s data was revised to a slightly better -0.1% from the initial -0.3% read. For 12 months, sales were up 8.4% from June 2021.

European stocks closed the week higher, helped by reduced expectations of a 100 basis-point hike by the Federal Reserve later this month after known hawks Fed Governor said they favored another 75 basis-point hike for this month, in spite of Wednesday’s red-hot inflation figures. A sharp increase in U.S. interest rates runs the risk of sending the U.S. economy, the world’s main growth driver, into recession. The stocks were mostly down during the week onn the back of losses in energy stocks.

Asia Pacific stocks closed the week lower. However, the stocks edged up at the end of the week as expectations of a 100 basis-point U.S. interest rate hike in July receded. Japan, South Korea, Australia, China and Hong Kong were mostly up at the end of the week. U.S. 10-year Treasuries yields dropped two basis points to 2.94% while its inflation in June hit a 40-year high, which has stoked expectations of a 100-basis point interest rate hike from the U.S. Federal Reserve.

On the global commodities markets, Crude Oil WTI closed the week lower by 6.89% and the ICE Brent Crude decreased by 3.22%. Gold futures prices decreased by 2.05% to settle at $1,706.50.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) retained the pump prices for fuel products at Ksh. 159.12, Ksh. 140 and Ksh. 127.94 for super, diesel and kerosene respectively. This follows after the government authorized an additional Ksh. 16.68 billion in the fuel subsidy kitty cushioning the prices from inflating further. The landing cost of imported super increased by 19.04% to $1,042.85 from last month while that of diesel rose 2.2% to $1,019. The shilling devaluation against the Dollar has since increased the cost of imports.

- Data from the Kenya National Bureau of Statistics (KNBS) shows that imports from Russia dropped 66 percent from Sh19.9 billion to Sh6.6 billion in the three months to March, forcing Kenya to turn to expensive sources of wheat, fertilizer and steel in light of the Ukraine crisis. This impacted prices in the local market leading to the 58-month high inflation of 7.9% recorded in June.

- The International Monetary Fund (IMF) board will meet on July 18 to review Kenya’s request for an additional Sh28 billion ($244 million) in emergency loan. Kenya had failed to meet some of the set conditions and is seeking a waiver. Key conditions were to reform State enterprises, conduct a special audit on Covid-19 expenditure, make public ownership of all companies awarded public tenders and enforce wealth declaration by public servants.

- According to the Kenya Mortgage Refinance Company (KMRC), Commercial banks and SACCOS added an average margin of 4.5 percent on funds obtained under a State-backed affordable housing plan.

- The Democratic Republic of Congo on Monday 11th July completed the last and most important step of joining the East African Community (EAC) giving it full rights and privileges to participate in EAC’s programs and activities. It’s entry is expected to remove restrictions on the free movement of people and goods and increase intra-EAC exports to DRC. Consequently, the Eat African GDP jumped up to Sh. 29 trillion.

- According to the manager of ILAM Fahari I-Reit, the company is still waiting for approval of its restructuring by the Capital Market Authority (CMA). This comes on the back of losses of Sh. 123.9 M recorded in December 2021 due to reduced returns as a result of high expense ratio.

- Current account deficits as a percentage of GDP rose to 5.3% in May 2022 as compared to 5.0 in May 2021. The wider deficit reflects a higher import bill resulting from sustained pressure from high fuel and import costs negating the improved dollar inflows from remittances and agricultural and services exports.

- The Bank of Canada raised raised its policy rate to 2.5% from 1.5% in an effort to tame surging inflation. Ethiopia’s inflation decelerated in June for the first time in four months as food prices increased at the slowest pace since August. The annual inflation rate dropped to 34% from 37.2% in May however, US inflation increased to a 40-year high of 9.1% in June, as consumer pressures intensify.

Get future reports

Please provide your details below to get future reports: