MONTH’S HIGHLIGHTS

- Kenya’s real gross domestic product (GDP) rose by 6.8% in Q1 2022 on a yearly basis. This is the highest first quarter level in 12 years according to Kenya National Bureau of Statistics (KNBS). The GDP growth was mainly attributed to increased activity in the financial services industry which grew by 14.4% from 9.9% in the previous quarter.

- The Kenya Shilling depreciated against the US dollar and is expected to continue its depreciating trend in 2022. This is due to election-related uncertainty due to the closeness of presidential polls which decreased investor confidence. Despite this, the Kenya Shilling has strengthened against other major international currencies including the Sterling pound and the Euro.

- The depreciation of the shilling inflated Kenya’s external debt by Sh69 billion in the first four months of 2022, negating an actual decline of $250 million in the currency value in the period. The debt fell at the end of April on account of some principal repayments to China and the Trade and Development Bank (TDB), but the shilling equivalent rose after the exchange rate weakened. The risk carried by a weakening currency on the external debt results in the Treasury requiring more shillings to service debt obligations including interest payments.

- Government securities and fixed deposits in banks offered Kenyan investors the highest returns in the first half of 2022. Listed shares declined in the wake of foreigners’ flights from emerging markets. Real estate investors also received small returns on a slow recovery of the property sector from the Covid-19 economic fallout. Returns from bonds auctioned this year averaged 13.06% while Treasury Bills offered rates of between 7.2% and 10%.

- The equities market witnessed share depreciation on reduced appetite for emerging markets after a jump in interest rates in developed markets such as the US. Investors’ wealth at the Nairobi Securities Exchange (NSE) shrank 26 percent in the first half, wiping out Sh653.7 billion of shareholders’ fortune.

- The government is seeking to borrow Sh60 billion from the tap sale of the infrastructure bond IFB1/2022/018 with a coupon rate of 13.7% floated earlier this month and two reopened 15-year papers FXD1/2022/03 & FXD1/2022/15 with coupon rates of 11.8% & 13.9% respectively.

- Kenya will launch its international financial centre in Nairobi to attract large foreign firms and boost capital flows. Despite Kenya’s relatively developed capital markets, 75% of all business financing in the economy was from the banking sector. The centre is meant to help direct international investment to Kenya, enabling companies and investors to take advantage of trade and investment opportunities.

- G7 leaders detailed plans to mobilise $600 billion in funding to fund the launch of infrastructure projects in middle and low-income countries. This is to counter China’s ambitious Belt and Road Initiative (BRI) launched by the Chinese government in 2013. The US has promised to raise $200 billion of the total through grants, federal funds and private investment, while the EU has announced a further $300 billion.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the CBK’s usable foreign reserves declined by 2.38% to stand at USD 7.98 billion(4.74 months of import cover). However, this meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

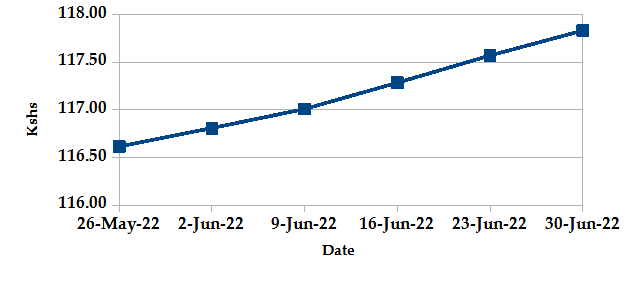

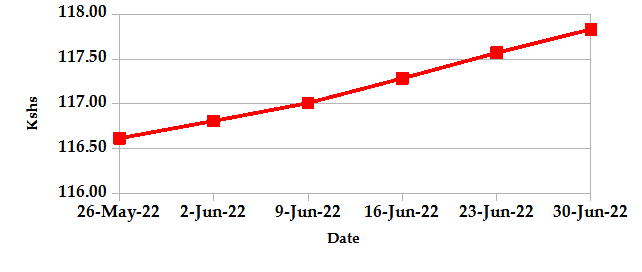

Currency

The Kenyan Shilling depreciated against the USD by 0.94%, exchanging at Kshs 117.83 up from Ksh 116.74 in the previous month. The depreciation is due to election-related uncertainty due to the closeness of presidential polls which decreases investor confidence. Despite this, the Kenya Shilling has strengthened against other major international currencies including the Sterling pound and the Euro.

USD Vs KSHS

STERLING POUND Vs KSHS

Inflation

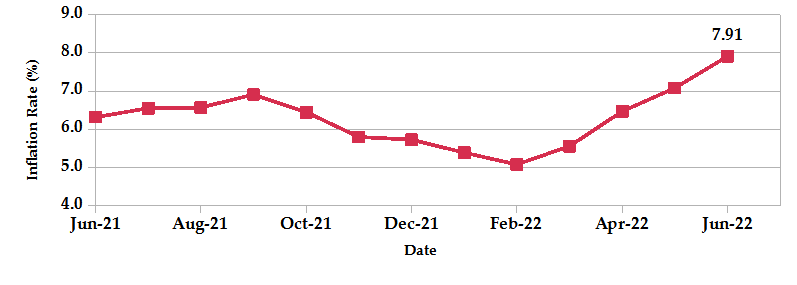

The overall year-on-year inflation increased to 7.91% in the month of June up from a revised figure of 7.08% in May. The increase is attributable to the increase in prices of commodities under; food and non-alcoholic beverages (13.8%), furnishings and household equipment (9.2%), transport (7.1%) and housing, water, electricity, gas and other fuels (6.8%) between June 2021 and June 2022.

INFLATION EVOLUTION

Liquidity

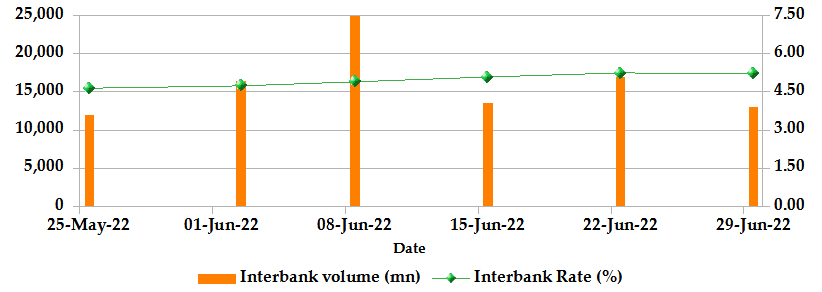

During the month, liquidity tightened as a result of government receipts from the issue of the infrastructure bond and reopening of the two government bonds which mopped up liquidity. The inter-bank rate increased to 5.21% up from 4.57%. The volume of inter-bank transactions increased from Kshs 14.34 billion to Kshs 19.25 billion. Commercial banks excess reserves increased from Kshs 15.1 billion to Kshs 31.20 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

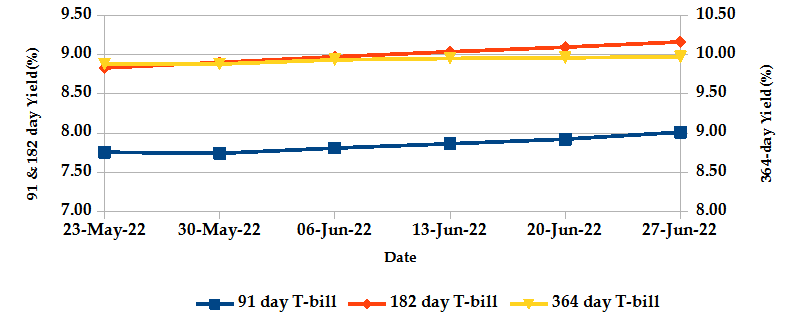

T-Bills

The T-bills recorded an overall subscription rate of 68.8% at the end of the month of June, compared to 91.0% recorded in the previous month. The undersubscription is partly attributable to investors’ preference for longer-dated T-bonds & infrastructure bonds which offered higher yields. The performance of the 91-day, 182-day and 364-day papers stand at 132.1%, 46.4% and 65.7% respectively. On a monthly basis, the yields on the 91-day, 182-day and 364-day papers increased by 3.47%, 2.94% and 0.94% respectively to 8.01%, 9.16% and 9.97%.

T-BILLS

T-Bonds

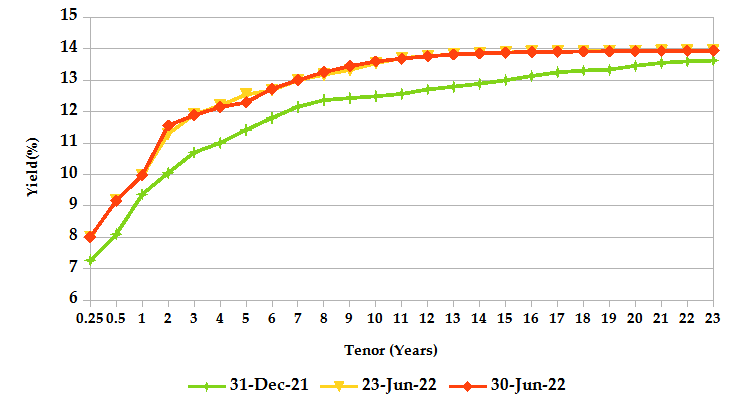

At the end of the month, the T-Bonds registered a turnover of Kshs 18.73 billion from 668 bond deals. This represents a weekly increase of 44.5% in turnover and a 6.4% decrease in bond deals. The yields on government securities in the secondary market increased during the month of June.

In the international market, yields on Kenya’s Eurobonds rose by an average of 16.4 basis points over the week.

YIELD CURVE

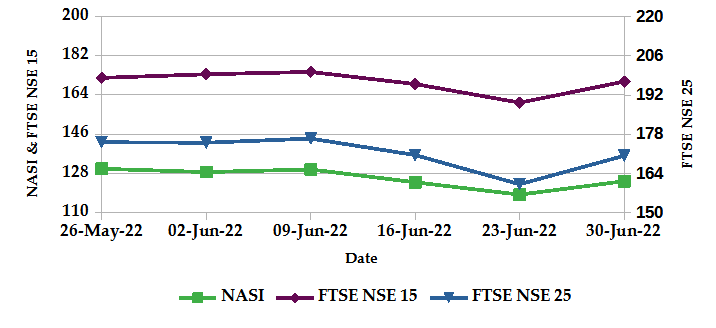

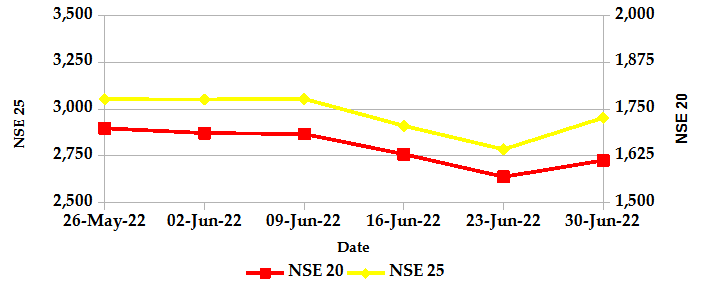

EQUITIES

During the month of June, the market capitalization declined by 4.15% to Kshs 1.94 trillion. Total shares traded and equity turnover plunged by 37.9% and 45.9% respectively to 69 million shares and Kshs 2.3 billion. NASI, NSE 20 and NSE 25 declined by 3.3%, 4.1% and 3.3% respectively on a monthly basis. On a weekly basis, the NASI, NSE 20 and NSE 25 gained by 6.2%, 2.5% and 6.7% respectively. The decline in NASI is a result of the depreciation of large-cap stocks such as Stanbic Holdings, Equity Group, Safaricom and Co-operative Bank.

NASI, FTSE NSE 15 and FTSE NSE 25

NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

- The derivatives market over the month recorded 208 contracts having a turnover of Kshs 13.8 million which was an increase from 74 contracts having a turnover of Kshs 6.1 million recorded over the last month.

- I-REIT market over the month recorded a turnover of Kshs 1.4 million with 128 deals which was a decrease from Kshs 2.1 million with 173 deals recorded over the last month.

- The ETF market over the month recorded a turnover of Kshs 272 million with 4 deals which was an increase from the last month which recorded no activity.

GLOBAL AND REGIONAL MARKETS

| Global Markets | Weekly Change | Monthly Change |

|---|---|---|

| S&P 500 | -0.27% | -8.39% |

| STOXX Europe 600 | 1.19% | -8.15% |

| Shanghai Composite (SSEC) | 3.96% | 6.66% |

| MSCI Emerging Market Index | 0.54% | -7.15% |

| MSCI World Index | -0.11% | -8.77% |

| Regional Markets | Weekly Change | Monthly Change |

|---|---|---|

| FTSE ASEA Pan African Index | -1.28% | -8.17% |

| JSE All Share | 1.85% | -8.13% |

| NSE All Share (NGSE) | 0.39% | -3.39% |

| DSEI (Tanzania) | 3.60% | -1.07% |

| ALSIUG (Uganda) | -0.78% | -8.08% |

- During the month, major global markets declined over investor concerns that aggressive monetary tightening to curb inflation will cause a global economic slowdown. In the USA, the S&P 500 and Dow Jones indices declined by 8.39% and 6.71% respectively from the previous month. In Europe, the continental index of STOXX Europe 600 and the UK’s FTSE 100 declined by 8.15% and 5.76% respectively.

- On a regional front, most markets declined amid sharp interest rate hikes by major central banks pushing investors to ramp up bets of a global economic recession. This coupled with the ongoing war in Ukraine and lockdowns in China, has sapped investor sentiment and sent risk assets lower. The FTSE ASEA Pan African index, representing the overall African markets, declined by 8.17% from the month of May. South Africa’s JSE All Share declined by 8.13%, Nigeria’s All Share Index declined by 3.39%, Tanzania’s DSEI declined by 1.07% and Uganda’s All Share Index declined by 8.08%.

- On the global commodities markets, the oil futures indices declined over concerns of a global slowdown. The Crude Oil WTI futures plunged by 7.77% from the previous month of May. The ICE Brent Crude Oil decreased in value by 5.68%.

Get future reports

Please provide your details below to get future reports: