Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 7,997 million (4.61 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar but gained against the Euro and the Sterling Pound to exchange at Ksh 118.07, Ksh 120.67 and 141.22 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 4.36% | 4.36% |

| Euro | -5.79% | -3.06% |

| Sterling Pound | -7.30% | -0.34% |

Liquidity

Liquidity in the money markets tightened, partly reflecting government payments which offset tax remittances. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.27% | 5.83% |

| Interbank volume (billion) | 18.27 | 20.59 |

| Commercial banks’ excess reserves (billion) | 31.20 | 31.00 |

Fixed Income

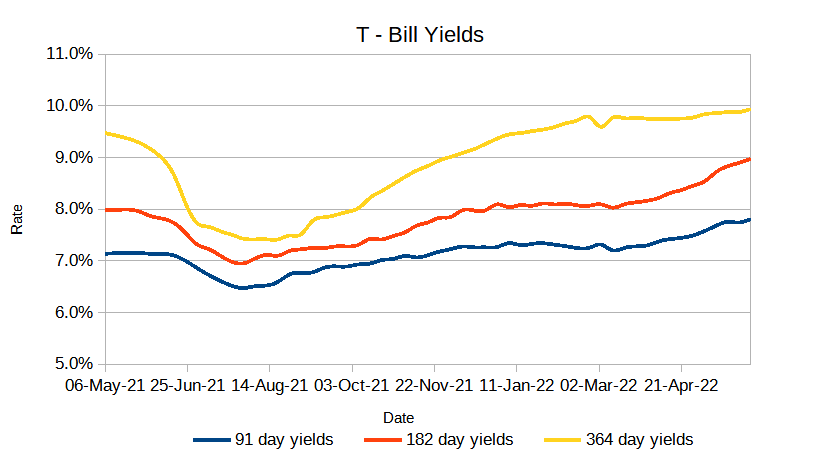

T-Bills

T-Bills were over-subscribed during the week with an increase in the overall subscription rate from 37.14% recorded in the previous week to 102.46%. The 91-day T-Bill got the highest subscription rate at 276.0% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 84.3% and 51.2% respectively. The acceptance rate increased by 10.71% to close the week at 98.44%.

T-Bonds

The bonds market had a lower demand for the week’s bond offers. Bonds turnover decreased by 31.87% from 18.73B in the previous week to 12.61B. Total bond deals decreased by 31.74%.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola and Ghana rose. Yields on Kenya’s Eurobonds generally increased by 37.7 basis points compared to the previous week, 0.34% and 8.85% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 13.03% | 0.51% | 0.43% |

| 2018 10-Year Issue | 9.22% | 0.39% | 0.35% |

| 2018 30-Year Issue | 5.94% | 0.28% | 0.31% |

| 2019 7-Year Issue | 11.01% | 0.47% | 0.53% |

| 2019 12-Year Issue | 7.33% | 0.23% | 0.23% |

| 2021 12-Year Issue | 6.55% | 0.16% | 0.41% |

Equities

NASI, NSE 20 and NSE 25 increased by 8.63%, 4.26% and 6.70% compared to last week bringing the year to date performance to -18.98%, -11.62% and -15.73% respectively. The market capitalization increased by 8.39% from the week to close at 2.110 trillion recording a year to date decline of 18.94%. The performance was driven by gains recorded by large-cap stocks. Top gains were recorded in Safaricom, KCB, StanChart and Equity which increased by 12.57%, 8.72%, 7.66% and 6.98% respectively.

The Banking sector had shares worth Kshs 1B transacted which accounted for 39.56% of the week’s traded value, Manufacturing & Allied sector had shares worth 111M transacted which represented 4.09% and Safaricom, with shares worth Kshs 1.3B transacted represented 49.40% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Home Afrika | 2.50% | 24.24% |

| Williamson Tea | 16.15% | 15.49% |

| Nation Media | -2.03% | 13.49% |

| HF Group | -1.84% | 12.69% |

| Safaricom | -26.08% | 12.57% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Kakuzi | 1.30% | -11.61% |

| Transcentury | -14.17% | -10.43% |

| Sanlam | -4.76% | -8.33% |

| Carbacid | 1.38% | -3.91% |

| Crown Paint | 32.13% | -2.89% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.12 | 1.04 | -50.93% |

| Derivatives Contracts | 36 | 22 | -38.89% |

| I-REIT Turnover | 0.16 | 0.31 | 91.43% |

| I-REIT Deals | 29 | 48 | 65.52% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -18.70% | 1.94% |

| Dow Jones Industrial Average (DJI) | -14.34% | 0.77% |

| FTSE 100 (FTSE) | -4.12% | 0.38% |

| STOXX Europe 600 | -14.87% | 2.45% |

| Shanghai Composite (SSEC) | -7.61% | -0.93% |

| MSCI Emerging Markets | -18.96% | 0.68% |

| MSCI World Index | -19.68% | 1.71% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -19.93% | -2.53% |

| JSE All Share | -7.34% | 4.14% |

| NSE All Share (NGSE) | 19.83% | -36.99% |

| DSEI (Tanzania) | -0.37% | 0.09% |

| ALSIUG (Uganda) | -12.66% | 6.33% |

U.S stocks closed the week mixed, as gains in the Healthcare, Consumer Goods and Technology sectors led shares higher while losses in the Basic Materials, Telecoms and Consumer Services sectors led shares lower. The Dow notched a weekly win Friday despite slipping into the red into close as a stronger monthly jobs report reaffirmed bets for the Federal Reserve to front-load rate hikes to slow inflation. The U.S. economy added 327,000 new jobs in June, while the unemployment rate was unchanged at 3.6%. Average hourly earnings slowed to 0.4% from 0.3% a month earlier.

European stocks closed the week lower, ending the week on a cautious note ahead of a speech by ECB President as well as the U.S. monthly jobs report. Despite ral bank actions’ suppressing impact on the aggressive rate hikes on global growth, European indices have rebounded to a degree after the brutal sell-off in the first half of the year, with investors trying to shake off concerns about a looming recession.

Asia Pacific stocks closed the week higher, as a U.S. rally sparked by hopes that policymakers can tackle inflation without causing a recession boosted investor sentiments. Japan, South Korea, Australia, China and Hong Kong were mostly up at the end of the week. As the US Planned to meet and discuss possible tariffs on Chinese goods and expectations of China to deliver 1.5 trillion Yuan stimulus to boost growth, the market expectations of an economic recovery was boosted.

On the global commodities markets, Crude Oil WTI closed the week lower by 3.36% and the ICE Brent Crude decreased by 1.57%. Gold futures prices decreased by 3.29% to settle at $1,742.30.

Week’s Highlights

- The Kenya Revenue Authority (KRA) recorded a revenue collection of KShs. 2.031 Trillion for the Financial Year 2021/2022 compared to KShs. 1.669 trillion collected in the last financial year exceeding its revised target of Kshs. 1.976 trillion. The revenue collection signifies a performance rate of 102.8% against the revised target and a revenue growth of 21.7% compared to the last financial year. The significant growth is attributed to improved tax collection and compliance.

- The government unlocked bonds to finance road projects in new Finance Act 2022 which allows the Kenya Roads Board(KRB) to set aside half of fuel tax collections to secure loans through options such as bonds to finance road projects.

- Kenya stood out in the 2021 global Findex after it was ranked among the top 5 countries that have made significant progress in digital finance .According to the World Bank’s Global Findex 2021 report it showed that 79% of Kenyan adults now have an account either at a bank, a financial institution or with a mobile money provider attributing this to the easy accessibility of financial services to the unbanked population.

- Fuel and LPG to face more tax under new policy after the treasury seeks to set the minimum value-added tax (VAT) rate at 12%. The policy comes amid the push by the International Monetary Fund (IMF) to double VAT on all petroleum products in order to cut the budget deficit and tame public borrowing.

- The Nairobi Securities Exchange(NSE) has waived the NSE transaction levy on all equity day trades for the next 30 days effective July 6, 2022 in an effort to encourage Kenyans to participate and take advantage of the daily price movements of securities listed on the NSE.

- American exports rose by $3 billion to $255.9 billion, narrowing the trade gap to $85.5 billion, led by a jump in sales of oil, natural gas and consumer goods, the data showed. Imports rebounded slightly after the steep decline in April, rising to $255.9 billion.

- Uganda’s Central Bank raised its benchmark policy rate by one per cent to 8.5% in an effort to tame surging inflation and pressure on the Dollar on the back of imported inflation. The Central Bank of Sri Lanka raised its rate to 15.5% as inflation and exhaustion of foreign currency reserves raise concern. Inflation in Turkey Hit 78.6%, the highest in 24 Years while Egypt’s inflation stood at 13.2% down from 13.5% recorded in May.

Get future reports

Please provide your details below to get future reports: