Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 8,114 million (4.82 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and slightly gained against the Euro and the Sterling Pound to exchange at Ksh 117.33, Ksh 122.42 and 142.18 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 3.70% | 0.24% |

| Euro | -4.43% | -2.33% |

| Sterling Pound | -6.67% | -3.25% |

Liquidity

Liquidity in the money markets tightened, partly reflecting government payments which offset tax remittances. Open market operations remained active. Diaspora remittances for the month of May stood at $339.7M representing a 7.57% and a -4.31% change year on year and month on month respectively.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 4.83% | 5.12% |

| Interbank volume (billion) | 27.91 | 10.55 |

| Commercial banks’ excess reserves (billion) | 14.80 | 45.20 |

Fixed Income

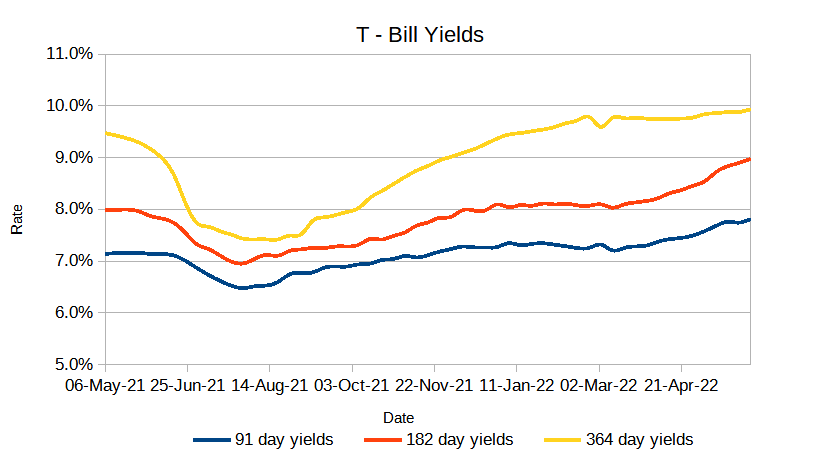

T-Bills

T-Bills remained under-subscribed during the week with an increase in the overall subscription rate from 61.26% recorded in the previous week to 80.80%. The 364-day T-Bill got the highest subscription rate at 90.0% while the 91-day T-Bill and 182-day T-Bill had a subscription rate of 76.8% and 73.2% respectively. The under-subscription is attributed to reduced investor sentiments in the face of high currency and inflation risks. The acceptance rate decreased by 1.40% to close the week at 94.00%.

T-Bonds

The bonds market had a higher demand for the week’s bond offers. Bonds turnover increased by 40.58% from 12.65B in the previous week to 17.78B. Total bond deals increased by 143.71%.

In the primary market, the Central Bank opened the tap sale for two fixed coupon treasury bonds; FXD1/2022/03 and FXD1/2022/15 dated 27/06/2022 seeking to raise Ksh. 25 Billion for budgetary support. The 3-year and 15 year bond will attract average yields of 11.766% and 13.942% respectively while the coupon rate was fixed at 11.766% and 13.942% respectively.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola and Ghana declined. Yields on Kenya’s Eurobonds generally increased by 1.14% compared to the previous week, 3.01% and 7.28% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 10.74% | 4.32% | 1.68% |

| 2018 10-Year Issue | 7.53% | 3.06% | 1.16% |

| 2018 30-Year Issue | 4.68% | 1.88% | 0.75% |

| 2019 7-Year Issue | 9.34% | 4.33% | 1.69% |

| 2019 12-Year Issue | 6.15% | 2.42% | 0.85% |

| 2021 12-Year Issue | 5.26% | 2.03% | 0.71% |

Equities

NASI, NSE 20 and NSE 25 decreased by 6.22%, 2.97% and 5.49% compared to last week bringing the year to date performance to -27.10%, -15.02% and -23.42% respectively. The market capitalization decreased by 6.24% compared to the previous week down to 1.897 trillion bringing the year to date performance to a negative position of 27.09%. The performance was driven by loses recorded by large-cap stocks. Top loses were recorded in Safaricom, Equity, EABL and ABSA which decreased by 8.99%, 7.65%, 6.39% and 6.09% respectively.

The Banking sector had shares worth Kshs 278M transacted which accounted for 13.09% of the week’s traded value, Manufacturing & Allied sector had shares worth 117.8M transacted which represented 8.37% and Safaricom, with shares worth Kshs 1.68B transacted represented 76.57% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Sameer Africa | 15.09% | 11.95% |

| Kapchorua Tea | -10.55% | 9.88% |

| Williamson Tea | 00.00% | 8.33% |

| Flame Tree Group | -3.20% | 8.04% |

| Crown Paints | 42.30% | 7.83% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Express Kenya | -26.83% | -12.28% |

| Longhorn | -22.17% | -11.21% |

| Safaricom | -36.30% | -8.99% |

| Car & General | 23.71% | -8.70% |

| Fahari I-REIT | -13.71% | -7.97% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 4.12 | 5.75 | 39.59% |

| Derivatives Contracts | 58 | 72 | 24.14% |

| I-REIT Turnover | 0.13 | 0.75 | 501.03% |

| I-REIT Deals | 38 | 38 | 00.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -23.39% | -5.79% |

| Dow Jones Industrial Average (DJI) | -18.30% | -4.79% |

| FTSE 100 (FTSE) | -6.51% | -4.12% |

| STOXX Europe 600 | -17.70% | -4.61% |

| Shanghai Composite (SSEC) | -8.69% | 0.97% |

| MSCI Emerging Markets | -18.55% | -4.74% |

| MSCI World Index | -23.31% | -5.90% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -14.02% | -3.49% |

| JSE All Share | -11.85% | -3.69% |

| NSE All Share (NGSE) | 20.34% | -2.68% |

| DSEI (Tanzania) | -3.04% | -1.58% |

| ALSIUG (Uganda) | -15.20% | -3.33% |

U.S stocks closed the week low, as gains in the Telecoms, Technology and Consumer Services sectors led shares higher while losses in the Oil & Gas, Utilities and Basic Materials sectors led shares lower. However, the stocks have been on a negative position for the better part of the week as investors weighed up the growing risk of a recession after the Federal Reserve delivered its biggest rate hike of 75 basis points since 1994 earlier this week.

European stocks closed the week lower amid a bruising week dominated by monetary policy tightening by a number of major central banks. The U.S. Federal Reserve hiked by 75 basis points on Wednesday. On Thursday, the Swiss National Bank unexpectedly lifted rates by 50 basis points and the Bank of England also also hiked its rate for the fifth consecutive time by 25 basis points.

Asia Pacific stocks closed the week higher, as investor sentiments relatively improved in light of hikes of key rates by central banks. China, Japan, South Korea, Australia and Hong Kong’ reported a decrease. However, the Bank of Japan held on to its strategy of pinning 10-year yields near zero at its policy meeting on Friday.

On the global commodities markets, Crude Oil WTI closed the week lower by 8.44% and the ICE Brent Crude decreased by 6.88%. Gold futures prices decreased by 1.79% to settle at $1,841.90.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) announced a Kshs. 9 increase on pump price of petroleum products to reach a new record high. Super petrol, Diesel and Kerosene will retail at Kshs 159.12, Kshs 140 and Kshs 127.94 respectively. The increase is attributed to surging crude oil prices as observed in the 19.67% increase registered by the Free on Board of Murban oil to $112.48 per barrel. This was further worsened by the depreciating shilling against the dollar which hit a record high of Kshs 117 per dollar last week and high taxes currently at Sh. 62.89 and Sh. 51.60 per liter of petrol and diesel respectively.

- The government will discontinue the fuel subsidy program pointing to costly petrol and a further increase in the cost of basic goods and services in the coming months. The Energy secretary noted that soaring oil prices have since exhausted the subsidy hence adding more expenses to the government. Global crude oil prices have been trading at over $100 per barrel.

- Parliament has approved a request by Laikipia County to borrow Sh1.16 billion through a domestic infrastructure bond at the stock market. The Senate and the Cabinet approved the guarantee for the borrowing following parliament clearance of the county to offer the bond in its may sitting.

- Kenya and the United States have agreed to restart trade talks as ministers meet at the 12th Ministerial Conference in Geneva. The ministers agreed to explore pathways towards a deeper bilateral trade and economic relationship that: promote sustainable and inclusive economic growth; benefits workers, consumers, and businesses and supports African regional economic integration.

- Foreign currency deposits in local banks recorded an all time high of Ksh. 834.5 billion in April on the back of shilling depreciation and cautionary accumulation by buyers. Deposits rose by Ksh 23.4 billion month-on-month.

- APA insurance political risk premiums registered a 62% increase compared to the previous year as individuals and firms race to protect their businesses and assets ahead of the August 9 polls.

- Kenya and Zambia signed six MoUs geared towards enhancing bilateral cooperation between the two countries. The 6 signed MoUs are;

- Memorandum of Understanding (MOU) on cooperation in the field of veterinary and animal health.

- MOU on cooperation in the field of international relations studies and research.

- MOU on cooperation in promotion of cooperatives.

- MOU between the Kenya Tourism Federation (KTF) and the Tourism Council Zambia.

- MOU between the Kenya Utalii College and the Zambia Institute for Tourism and Hospitality Studies.

- MOU on cooperation in the field of information, communication and technology.

Get future reports

Please provide your details below to get future reports: