Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves slightly declined from the previous week to stand at USD 9.70 bn (5.83 months of import cover). This meets CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against major currencies over the week, trading against the USD at Kshs 106.90 up from Kshs 106.67, Sterling Pound it traded at Ksh 135.21 from Ksh 133.31 and against the Euro, it traded at Ksh 121.17 up from Ksh 120.28 recorded last week. The shilling was under pressure due to increased dollar demand from merchandise importers and the energy sector. However, it remained relatively stable against the regional currency and declined against the Rand by 5 basis points.

Liquidity

Liquidity continued to improve from the previous weeks on account of government payments, open markets operations remained active during the week. The weekly mean of the daily weighted average inter-bank rate declined to 1.79% from 2.96% in the previous week. The volume transacted declined by 7.25% to stand at Kshs 3.81bn. Commercial banks’ excess reserves stood at Kshs 29.8 bn.

Fixed Income

T-Bills

T-bills remained oversubscribed at a rate of 358.18% which was an increase from 182.96% in the preceding week. The over-subscription is owed to high liquidity in the money market and investors’ preference for short-term papers. The subscription rates for the 91-day, 182-day, and 364-day papers increased to 948.10%, 273.73%, and 206.66%, respectively. The yields on the 91-day, 182-day, and 364-day papers, significantly decreased to 6.27%, 6.76%, and 7.70%, respectively.

T-Bonds

The bonds market registered reduced activity from the previous week with the total bond deals decreasing from 77 to 52, bonds turnover increased by 10.31% to Kshs 1.26 billion.. In the international market, yields on Kenya’s Eurobonds remained stable rising marginally by an average of 0.14 basis points. Similarly, the yields on the 10-year Eurobonds for Angola and Ghana increased marginally.

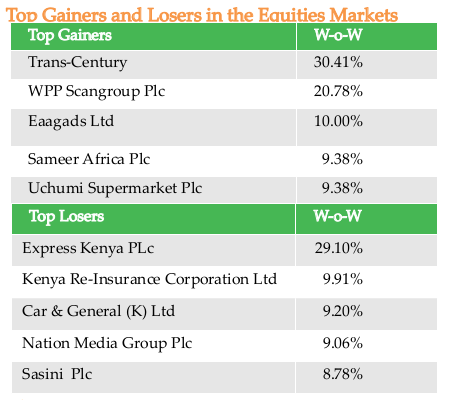

Equities

The Equity Market closed the week with 39.55m traded shares valued at Kshs 731m against 13.22m shares valued at Kshs 289.71m transacted in the previous week. The market capitalization declined marginally by 3.92% to Kshs 2.02 trillion.

NASI declined by 3.91%, while NSE 20 and NSE 25 were down by 2.28% and 3.26%, respectively. The performance of the NASI was driven by losses recorded by large-cap stocks, with Britam Holdings, Safaricom, ABSA Bank Kenya, BK Group Plc and Standard Chartered bank declining by 7.89%, 7.25%, 5.47%, 5.65%, and 6.28% respectively. There were net sell offs by foreign investors.

The Banking sector had shares worth Kshs 1bn transacted which accounted for 24.74% of the week’s traded value, Manufacturing & Allied sector represented 9.04%. Safaricom represented 60.62% of shares traded valued at Ksh 2.5bn trading at between Ksh 27.25 and Ksh 30.20.

Global stocks markets gained from the previous week. The MSCI World Index edged up by 1.43%, while the MSCI Emerging Markets soared by 4.47%. In the USA, DJI and S&P 500 climbed up 0.96% and 1.76%. In Europe, STOXX Europe 600 appreciated by 0.23% and the FTSE 100 declined again by 1.24%. China’s Shanghai Composite rose by 7.31%. The rise in the indices follows news on the positive progress towards a Covid-19 vaccine.

On the regional front, the FTSE ASEA Pan African index increased by 0.01%. The JSE All Share gained 1.64%, Nigeria’s NSE All Share dipped slightly by 0.12%. Within the EAC, Tanzania’s DSEI decreased marginally by 1.06% and Uganda’s ALSIUG remained constant.

On the global commodities market, the oil futures experienced rise in prices with the Crude Oil WTI and ICE Brent Crude soaring by 0.7% and 1.17%, respectively. This follows a fall in US unemployment. Gold futures prices increased by 0.78% to settle at $1,801.55 at the end of the week.

Alternative Investments

The were no active deals in the derivatives market at weeks end, open interest total was at 93.

The I-REIT market registered improved activity with a turnover of Kshs 101,618 from 12 unit deals against a turnover of Kshs 20,450 from 4 unit deals in the preceding week.

The was no activity in the ETF market.

Week’s Highlights

- TransCentury after nine years as a public company is seeking to be delisted from the NSE to meet a precondition for accessing new capital from private equity funds. A general proposal to take private the company will be submitted to shareholders during 30 July 2020 extraordinary general meeting to be held online. If successful, this will be the ninth company to be delisted from the bourse in recent years.

- Kenya Power, KPLC, has issued its third profit warning in a row citing reduced electricity consumption due to the

impact of Covid 19 restrictions on businesses. The company has lost Sh 5.6 billion in electricity sales in the four

months to June. - Kenya’ domestic export during quarter 1 2020, grew by 5.3 percent to Ksh 144.9 billion from growth in tea exports,

essential oils and titanium ores and concentrates. Tea and horticulture exports were the leading at Ksh 34.1 billion

and Ksh 35.3 billion, coffee exports fell by 10.2% compared to a similar period last year. The balance of payment

report from KNBS indicates that domestic exports of food and beverages accounted for 44.8% of the exports and

grew by 6.9% compared to Q1 2019. - The CMA has moved to institute a transitional payment system as it takes up the oversight role at the Nairobi Coffe

Exchange (NCE). CMA directed that the existing mechanism be utilized as the Direct Settlement System is being

utilized. The CMA Act through the Finance Act 2016, Spot Commodities Market was brought under the regulatory

oversight of CMA. The Authority is mandated to license the Coffee Exchange and the Coffee Brokers. - The World Bank in Kenya Public Expenditure Review proposed options for fiscal consolidations and support

macroeconomic stability in the medium term to the Government of Kenya (GOK). It has recommended that the

government should resume its fiscal consolidation effort to maintain sustainability, crowd in private sector led

growth, and rebuild fiscal buffers. The world bank projects a baseline growth of 1.5% in 2020 due to the dampened

growth prospects. - CBK latest figures shows that government domestic debt in Treasury Bonds has risen from Ksh 2.09 Trillion as at

31st March 2020 to Ksh 2.22 Trillion as of 26th June 2020. The gross domestic borrowing of the government

including Treasury Bills and Bonds, overdraft from CBK, and other domestic debt now stands at Ksh 3.178 Trillion.

Treasury Bonds account for 69.84% while Treasury Bills are 23.87% of the debt.

Get the report

Please provide your details here below to get the full report: