Foreign Exchange reserves

The CBK’s usable foreign exchange reserves strengthened from the previous week to remain adequate at USD 7.81 billion (4.7 months of import cover), above the statuory requirement of maintaining at least 4.0 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

During the week, the Kenyan Shilling gained against the USD, trading at Kshs 106.01 down from Kshs 107.29 in the previous week. This is due to reduced dollar demand from oil and merchandise importers and commercial banks selling off their excess dollars.

Liquidity

Liquidity improved from the previous week supported by government payments which offset tax receipts. The average inter-bank rate declined by 920 basis points to 4.13% down from 4.55% while the inter-bank volume fell from Kshs 13.67bn to Kshs 7.80bn. Commercial

banks’s excess reserves moved to Kshs 39.9bn from Kshs 42.70bn.

Fixed Income

T-Bills

T-Bills remained undersubscribed with an overall subscription rate of 62.57%. This is indicative of investors’ caution in the market amid speculations about deferral of interest payments on the treasury papers. The subscription rate for the 182-day paper grew from 26.75% to 37.95%, while the subscription rates for the 91-day and 364-day papers declined from 111.82% and 107.51% to 61.07% and 87.79% respectively. The yields on the 91-day and 182-day papers increased by 20 basis points to 7.25% and 8.15% respectively, while the yield on the 364-day paper rose by 50 basis points to 9.16%.

T-Bonds

The bonds market was on an upward trajectory with the bonds turnover over the week rising sharply by 77.18% to Kshs 11.81 billion up from Kshs 6.67billion. Total bond deals increased to 556 from 420. In the international market, yields on Kenya’s Eurobonds declined by an average of 60.5 basis points.The CBK released auction results for the 5-year bond issue no. FXD1/2020/5 which had a performance rate of 69.06% after receiving bids of Kshs 34.53billion against the total amount offered of Kshs 50billion. The bond’s coupon rate and weighted average rate of accepted bids is 11.67%. Its purpose is to offer budgetary support.

Equities

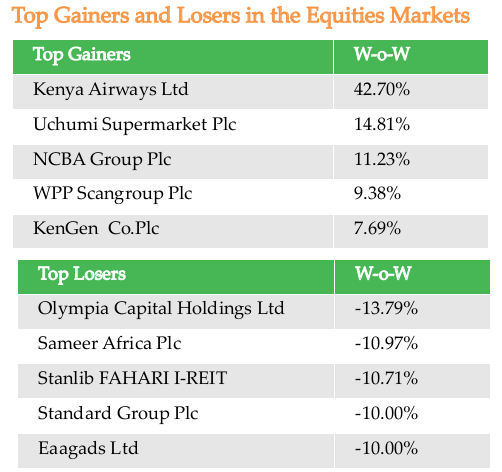

The equities market recorded increased activity with the total shares traded and equity turnover increasing by 71.50% and 202.50% to 118 million shares and Kshs 4.85 billion, respectively. The market capitalization rose marginally by 0.85% to Kshs 2.15 trillion. NASI, NSE 20 and NSE 25 indices gained by 0.84%, 3.91% and 1.83%, in that order. The performance of the NASI was driven by gains recorded by large-cap stocks such as NCBA, Bamburi, KCB, Equity Group, ABSA and Co-operative Bank. However, the gain was weighed down by declines recorded by large-cap stocks such as SCBK, BAT, EABL and Safaricom.

The developed markets were on an upward trend as indicated by the gains in the MSCI World Index which recorded an upward change of 2.85% from the previous week to 2061.89. This comes as countries look forward to relaxation of measures aimed at slowing the spread of COVID-19. In the US stock market; the Daw Jones Industrial Average edged higher by 2.56% to close at 24,331.32 while the S&P 500 gained by 3.50% to 2929.8. In Europe, the STOXX Europe 600 and FTSE 100 soared by 1.08% and 3.00% to 341.05 and 5935.98 respectively. However, the MSCI Emerging Markets index shed 56 basis points to stand at 911.65 at the close of the week. On the continental front, the FTSE ASEA Pan African index appreciated by 1.11% to 1159.81. The South African, JSE All Share and Nigerian, NSE All Share went up by 1.32% and 4.45% respectively. Within the East African Community, the DSEI(Tanzania) and ALSIUG(Uganda) outperformed Kenya’s NASI after the two indices surged by 4.00% and 7.69%,respectively. The National Bank of Rwanda slashed its policy rate to 4.5% down from 5.5%. The decision is aimed at supporting commercial banks to continue financing the economy. The Rwandese government projects its economy growth to fall to 3.5%.

On the continental front, the FTSE ASEA Pan African index appreciated by 1.11% to 1159.81. The South African, JSE All Share and Nigerian, NSE All Share went up by 1.32% and 4.45% respectively. Within the East African Community, the DSEI(Tanzania) and ALSIUG(Uganda) outperformed Kenya’s NASI after the two indices surged by 4.00% and 7.69%,respectively. The National Bank of Rwanda slashed its policy rate to 4.5% down from 5.5%. The decision is aimed at supporting commercial banks to continue financing the economy. The Rwandese government projects its economy growth to fall to 3.5%.

Alternative Investments

The Derivative Market closed the week with a total of 11 contracts worth Kshs 345,980. The Safaricom contract expiring in 18th June 2020 had 6 contracts valued at Kshs 178,000 transacted.

The I-REIT market recorded a turnover of Kshs 901,458 from 41 unit deals. Hass consult released their Hass Property Index Q1’2020 report, which indicated that the Nairobi Metropolitan Area residential market recorded a slight decline in performance, recording a 0.02% drop in annual price as at Q1’2020, compared to a 3.3% increase recorded in Q1’2019.

Week’s Highlights

- Following ammendment to the Retirement Benefits Act, the treasury Secretary published draft regulations showing rules and limits of accessing pension savings for home purchase. The changes will allow the workers to use up to Kshs 7 million or a maximum of 40% of their retirement savings to buy their first residential houses boosting home ownership and lift the sluggish property market. Trustees of the various retirement schemes will lay out the rules to be followed before one can access their pension to fund their home purchase.

- The Actuarial Society Kenya(TASK) presented its proposals on dealing with COVID-19 to the government. The institution proposed the suspension of statutory contributions to the NSSF, NITA, possibly even NHIF and other statutory levies by employers and employees for a period of six months. The body further proposed relaxation of the RBA Act to allow scheme members to use their retirement funds to access a cash backed loan of up to 25% of

the funds subject to a maximum of Kshs 500,000. - Bamburi Cement released its financial results for the year ended 31st December 2019. The company recorded 1.1% drop in turnover to Kshs 36.8 billion down from Kshs 37.2 billion in 2018. Profit before tax increased by 17% to Kshs 728 million, impacted by 44% rise in operating profit brought about by cost cutting and optimization initiatives undertaken. However, total comprehensive income plunged by 74% to Kshs 350 million down from Kshs 1,348 billion registered in 2018.This is due to increase in tax charge by 669% to Kshs 369 million. The company’s book value declined by 1.03% to Kshs 40.3 billion with the board not recommending a dividend payment.

- The Nairobi Securities Exchange(NSE) extended the suspension from trading of Athi River Mining Cement Plc shares. The extension of suspension was issued by the Capital Markets Authority (CMA) pursuant to Regulation 22(2) (b) of the Capital Markets (Securities). Athi River Mining Cement Plc was placed in administration following the appointment of Joint Administrators by the board to run its business in accordance with the Insolvency Act of 2015 on August 17, 2018.

- Dutch investor DOB Equity increased its stake of an undisclosed amount in Moringa School, a mobile software applications development school, enabling the latter to launch a remote learning facility. The investment was sparked by increasing demand of remote e-platforms skills largerly driven by the COVID-19 pandemic. With the additional capital the school expects to increase its reach across East Africa.

- Diaspora remittances rose by 6.2% to Kshs 75.6 billion in Q1 2020 up from Kshs 71.13 billion recorded over the same period in 2019. Further, the remittances increased by 4.5% to Kshs 24.4 billion in the month of March from the month of February, 2020. This comes after a decline of 16.4% was recorded in the month of February when compared to January. The increase in the diaspora remittances indicates historical behaviour of Kenyans abroad sending money home to support families during periods of economic crisis.

- Private equity firm Fanisi Capital acquired minority stake in St Bakhita Schools valued Kshs 265 million ($2.5 million).This becomes the third investment that Fanisi is making in the education sector after Hillcrest International Schools and Kitengela International Schools. The deal fits within the PE firm’s investment strategy which aims to invest in ambitious enterpreneurs providing high quality education.

- South Africa’s Standard Bank Group lent Kshs 3 billion to Dubai-based conglomerate Majid Al Futtaim to expand its supermarkets business in Kenya through the Carrefour franchise. The credit facility indicates further expansion of the retailer which has been expanding as seen through its increase in asset base by 57.2% to a total assets of Kshs 7.1billion in the year ended December 2019. Its revenues over the same period rose by 2.7% to Kshs 18.2billion.