Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.22% to USD 9,178 million (4.7 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, but appreciated against the Sterling Pound and the Euro to exchange at KES 129.49, KES 159.14 and KES 133.27 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 0.14% | 0.15% |

| Sterling Pound | -1.88% | -0.75% |

| Euro | -1.08% | -0.08% |

Liquidity

Liquidity in the money markets decreased, with the average inter-bank rate increasing from 11.06% to 11.27%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 11.06% | 11.27% |

| Interbank volume (billion) | 22.71 | 34.58 |

| Commercial banks’ excess reserves (billion) | 31.10 | 28.80 |

Fixed Income

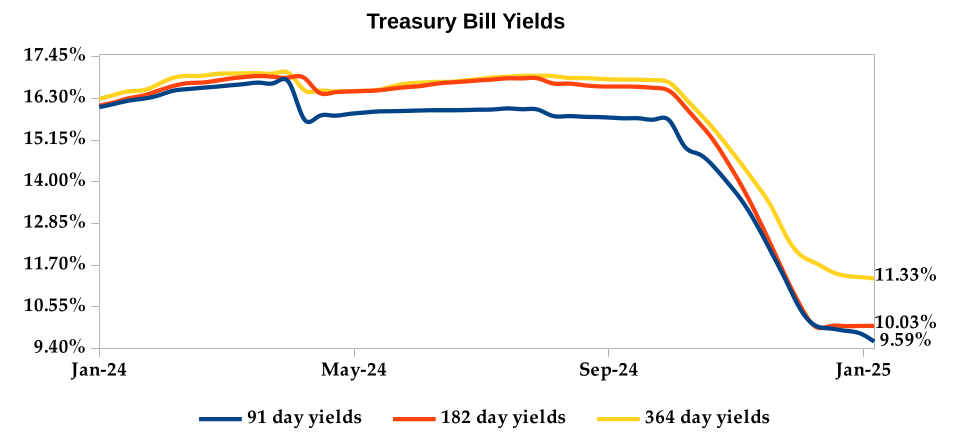

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 138.10% from 65.38% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 333.12%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 97.11% and 101.07% respectively. The acceptance rate decreased by 26.17% to close the week at 73.79%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 357.39% from KES 6.69 billion in the previous week to KES 30.58 billion. Total bond deals increased by 117.91% from 201 in the previous week to 438.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.28% week-on-week, month-to-date and year-to-date. The yield on the 10- year Eurobond for Angola decreased while Ivory Coast increased slightly.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.28% | -0.28% | -0.28% |

| 2018 30-Year Issue | -0.26% | -0.26% | -0.26% |

| 2019 7-Year Issue | -0.19% | -0.19% | -0.19% |

| 2019 12-Year Issue | -0.31% | -0.31% | -0.31% |

| 2021 13-Year Issue | -0.32% | -0.32% | -0.32% |

| 2024 6-Year Issue | -0.32% | -0.32% | -0.32% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 2.60%, 2.70%, 0.79% and 0.17% higher compared to the previous week, bringing the year-to-date performance to 3.43%, 4.21%, 1.55% and 0.81% respectively. Market capitalization also gained 2.60% from the previous week to close at KES

2.04 trillion, recording a year-to-date increase of 3.43%. The performance was driven by gains recorded by large-cap stocks such as Stanbic, Safaricom and Standard Chartered of 8.84%, 4.32% and 3.00% respectively. This was however weighed down by the losses recorded by large-cap stocks such as Co-operative Bank and NCBA of 5.95% and 4.53% respectively.

The Banking sector had shares worth KES 1.4BM transacted which accounted for 51.41% of the week’s traded value. Manufacturing & Allied sector had shares worth KES 362M transacted which represented 13.03% and Safaricom, with shares worth KES 678M transacted, represented 24.43% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| KQ | 49.87% | 49.87% |

| Kenya Power | 33.98% | 28.04% |

| ScanGroup | 15.14% | 25.11% |

| HF Group | 26.09% | 22.36% |

| Unga | 13.33% | 18.06% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | -5.34% | -1042% |

| Crown Paint | -5.60% | -9.99% |

| Express | -13.89% | -9.88% |

| Nation Media | -5.90% | -8.75% |

| I&M Holdings | -5.69% | -6.09% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.04 | 9.07 | 21,100.70% |

| Derivatives Contracts | 1.00 | 47.00 | 4,600.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -0.71% | -1.94% |

| Dow Jones Industrial Average (DJI) | -1.07% | -1.86% |

| FTSE 100 (FTSE) | -0.14% | 0.30% |

| STOXX Europe 600 | 0.16% | 0.65% |

| Shanghai Composite (SSEC) | -2.88% | -1.34% |

| MSCI Emerging Markets Index | -1.80% | -1.50% |

| MSCI World Index | -0.80% | -1.59% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 2.46% | 1.22% |

| JSE All Share | -1.23% | -1.64% |

| NSE All Share (NGSE) | 2.20% | 1.80% |

| DSEI (Tanzania) | 1.42% | 0.82% |

| ALSIUG (Uganda) | 4.00% | 3.38% |

Global and Continental Markets

The US stock market closed the week on a downward trajectory, as investors assessed the stronger-than-expected jobs report that lowered expectations for further interest rate cuts by the Federal Reserve in 2025.

European stock markets closed the week in the green zone, boosted by the gains recorded by mining, industrial, metals & mining and general industrial sectors.

Asian stock markets closed the week lower, weighed down by broad-based sector losses. The People’s Bank of China’s (PBoC) decision to halt treasury bond purchases dampened investor sentiment, leading to higher yields. Notably, exports grew less than expected, while imports unexpectedly shrank.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 3.53% and 4.25% higher at $76.57 and $79.76 respectively. Gold futures prices also settled 2.27% higher at $2,715.00.

Week’s Highlights

- Kenya’s economy expanded 4.0% year-on-year in Q3 2024 from 4.6% in the previous quarter, according to the data by Kenya National Bureau of Statistics (KNBS). This was primarily due to a general slowdown across the various sectors of the economy. Agriculture, contributing over a fifth of GDP, grew at a slower rate of 4.2% due to a 12.2% decline in tea production, despite gains in sugarcane and milk production. Other sectors experiencing slower growth included manufacturing, accommodation services, utilities, ICT, professional & administrative services, finance and real estate. Additionally, output contracted in the mining & quarrying and construction sectors.

- The Stanbic Bank Kenya Purchasing Managers’ Index (PMI) edged 50.6 lower in December 2024 from 50.9 in November. Despite the marginal decline, this marks the third consecutive month of expansion in the private sector, driven by increases in output, new orders and employment. However, job growth remained modest. Output growth was fueled by a rise in new orders, reflecting improved customer purchasing power, increased new bookings and successful marketing campaigns. On the price front, input costs surged at the fastest pace in eleven months, driven by strong input demand, currency depreciation and higher taxes. Agriculture and manufacturing sectors experienced the most significant input and output price inflation. Business sentiment remained subdued, with optimism for future activity falling to the second-lowest level on record.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke Kenya Airways (KQ) shares resumed trading on the Nairobi Securities Exchange (NSE) following a five-year suspension. The NSE cited KQ’s return to profitability and the withdrawal of a proposed nationalisation bill as the reasons for lifting the trading freeze. KQ recorded a net profit of KES 513 million in the first half of 2024, its first profit in a decade. The government remains the largest shareholder, having injected KES 83 billion to support KQ’s restructuring.

- The Retirement Benefits Authority (RBA) has announced significant amendments to pension laws, including an increase in the tax-deductible contribution limit to KES 360,000 annually from KES 240,000. This move aims to incentivise retirement savings and provide relief to both employees and employers. Furthermore, the RBA has introduced tax deductibility for post-retirement medical funds up to KES 15,000 per month, acknowledging the rising healthcare costs.

- Kenya has ratified the Organization for Economic Co-operation and Development’s (OECD) Multilateral Convention on Base Erosion and Profit Shifting (BEPS). This move signifies Kenya’s commitment to combating tax avoidance by multinational corporations. The BEPS convention, which has been adopted by over 85 countries, aims to update existing tax treaties and close loopholes exploited by companies to shift profits to low-tax jurisdictions. By adopting the convention, Kenya joins the global effort to ensure fair taxation and prevent revenue erosion. The convention will enter into force in Kenya in May 2025.

- The Caixin China General Services PMI increased to 52.2 in December 2024 from 51.5 in November, exceeding market expectations and marking the fastest expansion since May. This growth was primarily driven by a surge in new domestic orders, while new export business contracted for the first time since August 2023. Employment declined marginally for the first time in four months due to resignations and cost pressures. Input costs rose modestly but accelerated for the first time in three months, primarily due to higher material and labor costs. This led to the first increase in selling prices since June as businesses passed on cost increases to clients.

- The HCOB Eurozone Composite PMI edged up to 49.6 in December from 48.3 in November. While the services sector expanded modestly, it was offset by a sharp decline in manufacturing activity, particularly in Germany, France and Italy. Spain and Ireland bucked the trend, with Spain experiencing its fastest private-sector growth since March 2023. New orders continued to fall for the seventh consecutive month, reflecting weak domestic and export demand. Employment declined at the fastest pace in four years, driven by manufacturing job cuts, although the services sector added jobs modestly. Price pressures intensified, with input costs rising at the fastest rate since July, particularly in the services sector, pushing up overall inflation.

- 5 Eurozone inflation increased to 2.4% in December 2024 from 2.2% in November, marking the third consecutive month of acceleration. This uptick was primarily driven by base effects from last year’s sharp energy price declines. Energy prices rose for the first time since July, while services inflation also accelerated. Food inflation remained steady and non-energy industrial goods inflation eased slightly. Inflation varied across major economies, with increases observed in Germany, France and Spain, but it slowed down in Italy. Core inflation, excluding volatile food and energy prices, held steady at 2.7%. Despite the recent uptick, the European Central Bank (ECB) expects inflation to return to its 2% target by the end of the year.

Get future reports

Please provide your details below to get future reports: