MONTH’S HIGHLIGHTS

- The Monetary Policy Committee (MPC) lowered the benchmark lending rate by 75 basis points to 11.25% from 12.00% at its 5th December meeting, citing the success of previous measures in reducing inflation below the mid-point of the target range of 5%, stabilising the exchange rate and anchoring inflation expectations. The MPC observed a moderation in non-food non-fuel inflation and noted that global central banks are easing rates amid declining inflationary pressures. The decision allows for a gradual easing of monetary policy while maintaining exchange rate stability, which is expected to lower borrowing costs, boost economic activity and reduce government debt servicing costs.

- Inflation increased to 2.99% in December 2024 from 2.76% in November. This was primarily driven by higher food, electricity and transport prices. The food and non-alcoholic beverages index increased by 0.7%, driven by higher food prices. The housing, water, electricity, gas and other fuels index increased by 0.2%, mainly due to increase in electricity prices. Additionally, despite the decrease in diesel and petrol prices ,the transport index increased by 1.8% mainly due to elevated bus/matatu fares.

- Amsons Group secured a 96.54% controlling stake in Bamburi Cement following a series of block trades, including a major purchase of 212.7 million shares on 19th December 2024. This acquisition gives Amsons the option to buy out remaining minority shareholders of 3.46% and potentially delist Bamburi from the NSE, pending regulatory approvals.

- The Government extended its Government-to-Government (G-to-G) oil import deal with Gulf oil companies (Saudi Aramco, ADNOC and ENOC), citing its success in stabilizing the Shilling and reducing fuel prices. The deal, which allows payments in Kenyan Shillings and offers 180-day credit terms, has reportedly lowered the Shilling-Dollar exchange rate from Kshs 166 to Kshs 129 and reduced petrol prices from Kshs 217 to Kshs 177 per litre.

- The President signed into law seven bills, including the Tax Laws (Amendment), Tax Procedures (Amendment), Business Laws (Amendment) and Kenya Revenue Authority (Amendment) Bills. Key changes include the introduction of a 6% Significant Economic Presence (SEP) tax on multinational firms, an increase in the mortgage interest deduction limit to Kshs 360,000 and excise duty exemptions for locally assembled electric vehicles. The Business Laws (Amendment) Bill raised banks’ core capital requirements to Kshs 10 billion and empowered the CBK to regulate non-deposit-taking lenders. Additionally, the Kenya Revenue Authority Act now allows the Commissioner-General to appoint Deputy Commissioners with board approval. These laws aim to streamline tax compliance, support local industries and strengthen financial regulation.

- The World Bank revised its economic growth forecast for Kenya to 4.7% for 2024, from the initial estimate of 5%. This downward revision reflects the impact of severe floods, political unrest and tighter monetary policy. While the forecast remains above the Sub-Saharan Africa average, the World Bank has highlighted concerns about fiscal discipline, debt sustainability and the impact of high interest rates on private sector activity. To mitigate these risks and sustain economic growth, the government will need to prioritise revenue mobilisation, fiscal consolidation and prudent debt management.

- The Fed reduced the federal funds rate by 25 basis points in December 2024, bringing the borrowing cost to the 4.25%-4.5% target range. This marked the third consecutive rate cut this year, aligning with market expectations. However, the Fed signaled a less aggressive easing path for 2025, now projecting only two further cuts of 50bps compared to the previous forecast of 100bps. The Fed also revised its economic outlook upward, forecasting stronger GDP growth and higher inflation through 2026, while anticipating slightly lower unemployment.

- UK inflation rose for the second consecutive month, reaching 2.6% in November 2024 from 2.3% in October. This marked the highest rate in eight months, driven primarily by rising costs in recreation and culture (particularly live entertainment and computer games), housing & utilities (especially rent) and food. On a month-on-month basis, overall inflation edged up by 0.1%. Core inflation also increased to 3.5% year-on-year, slightly below expectations.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves increased by 2.15% to settle at $9.20 billion (4.70 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover and EAC region’s convergence criteria of 4.5 months of import cover.

Currency

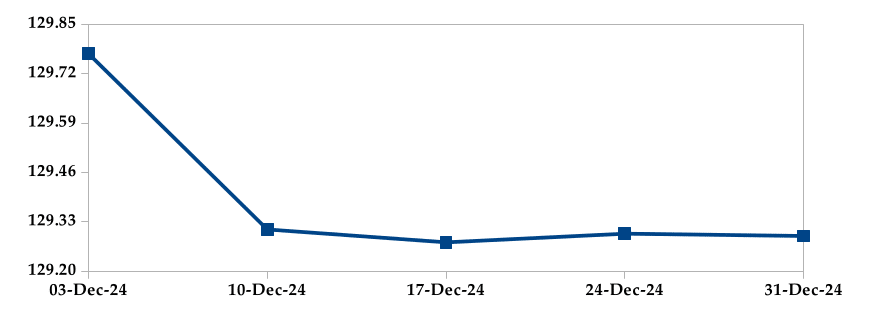

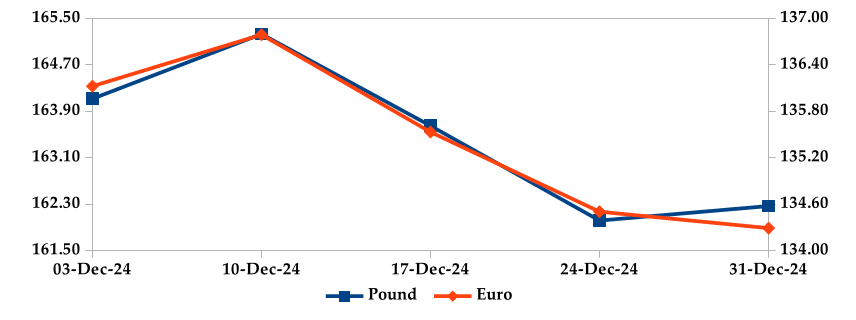

The Kenyan Shilling appreciated against the USD, the Sterling Pound and the Euro by 0.30%, 1.55% and 2.04%, exchanging at Kshs 129.29, Kshs 162.27 and Kshs 134.29 respectively at the end of the month, from Kshs 129.68, Kshs 164.82 and Kshs 137.09 in the previous month. The observed appreciation the Dollar is attributed to increased foreign inflows.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

This overall year-on-year inflation increased to 2.99% in December 2024 from 2.76% in November. This was primarily driven by higher food, electricity and transport prices.

INFLATION EVOLUTION

Liquidity

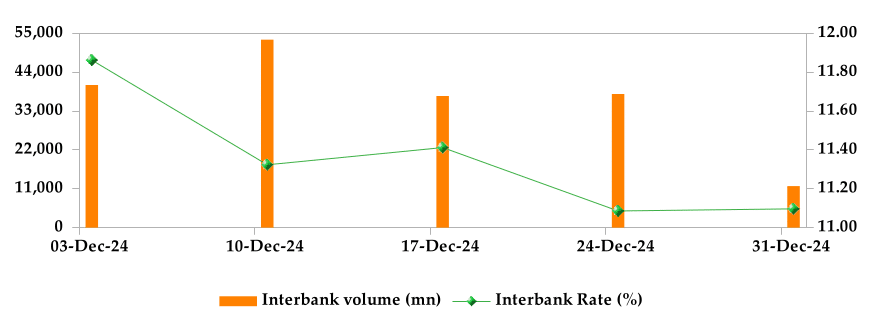

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 11.96% to 11.42%. The volume of inter-bank transactions increased from Kshs 32.01 billion to Kshs 39.34 billion. Commercial banks excess reserves decreased from Kshs 44.80 billion to Kshs 44.00 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

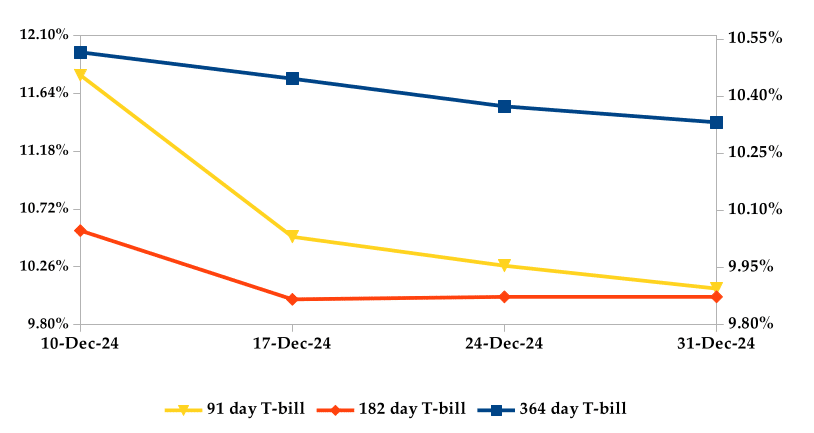

T-bills recorded an overall subscription rate of 80.06% during the month of December, compared to 335.21% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 208.33%, 33.30% and 75.52% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers decreased by 12.04%, 11.61% and 8.65% to 9.90%, 10.02% and 11.41% respectively.

T-BILLS

T-Bonds

During the month, T-Bonds registered a total turnover of Kshs 120.18 billion from 2,298 bond deals. This represents a monthly increase of 9.89% and a decrease of 8.77% respectively. The yields on government securities in the secondary market also decreased during the month of December.

In the primary bond market, CBK re-opened FXD1/2018/015 and FXD1/2022/025 treasury bonds in an effort to raise Kshs 30.0 billion. The coupon rates are 12.65% and 14.19% respectively.

In the international market, yields on Kenya’s Eurobonds increased by an average of 45 basis points.

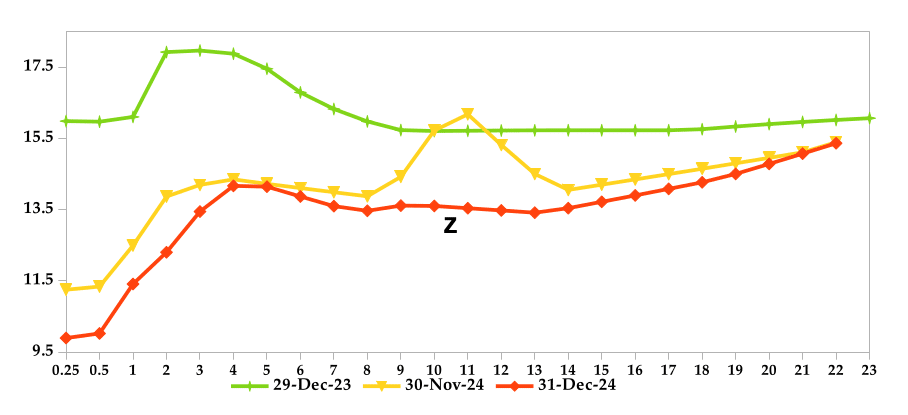

YIELD CURVE

EQUITIES

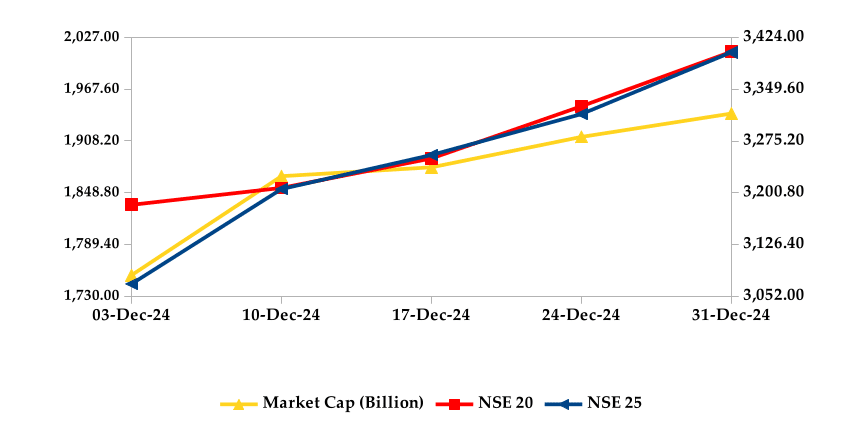

During the month, market capitalization gained 11.10% to settle at Kshs 1.94 trillion. Total shares traded increased by 75.40% to 826.05 million shares and equity turnover increased by 367.97% to close at Kshs

28.95 billion. On a monthly basis, NASI, NSE 20, NSE 25 and NSE 10 settled 10.71%, 8.02%, 11.08% and 11.30% higher respectively. The performance was as a result of gains recorded by large cap stocks such as ABSA, Co-operative Bank, Standard Chartered and Safaricom of 20.74%, 19.20%, 15.01% and 13.67% respectively.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | -2.50% | 24.01% |

| STOXX Europe 600 | -1.06% | 5.50% |

| Shanghai Composite (SSEC) | 0.76% | 13.15% |

| MSCI Emerging Market Index | -0.29% | 4.96% |

| MSCI World | -2.68% | 16.99% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 0.64% | 3.13% |

| JSE All Share | -0.88% | 8.72% |

| NSE All Share (NGSE) | 5.56% | 35.45% |

| DSEI (Tanzania) | -1.25% | 21.29% |

| ALSIUG (Uganda) | 4.78% | 37.14% |

Get future reports

Please provide your details below to get future reports: