Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.07% to USD 8,485 million (4.4 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 129.20, KES 167.50 and KES 139.81 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -16.19% | -0.45% |

| Euro | -19.49% | -0.17% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate marginally increasing from 11.91% to 11.97%, as offset tax remittances more than government payments. Remittance inflows totaled $418.50 million in September 2024, a 2.04% decrease from $427.20 million in August 2024 and a 22.93% rise from $340.44 million in September 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 11.91% | 11.97% |

| Interbank volume (billion) | 44.03 | 41.86 |

| Commercial banks’ excess reserves (billion) | 46.30 | 17.80 |

Fixed Income

T-Bills

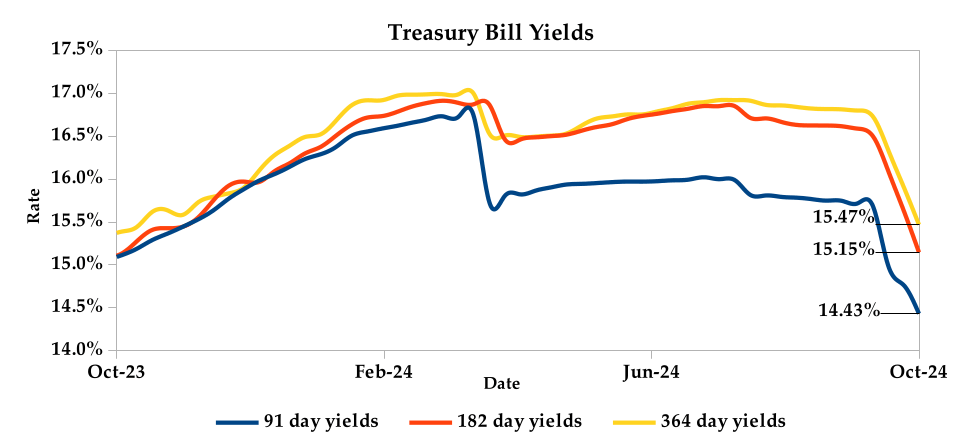

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 357.33% from 337.22% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 855.70%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 281.47% and 233.84% respectively. The acceptance rate increased by 14.02% to close the week at 48.69%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 44.12% from KES 34.44 billion in the previous week to KES 19.24 billion. Total bond deals also decreased by 28.57% from 588 in the previous week to 420.

In the primary bond market, CBK re-opened FXD1/2023/10 and FXD1/2022/15 treasury bonds in an effort to raise KES 25.0 billion. The coupon rates are 14.15% and 13.94% respectively. The sale runs from 25/10/2024 to 06/11/2024. Additionally, CBK re-issued FXD1/2024/10 bond with a coupon rate of 16.00% targeting to raise KES 20 billion. The sale runs from 25/10/2024 to 13/11/2024.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.25% compared to the previous week, 0.42% month-to-date and decreased by 0.44% year-to-date. The yield on the 10- year Eurobond for Angola decreased marginally while that of Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.92% | 0.52% | 0.24% |

| 2018 30-Year Issue | 0.02% | 0.36% | 0.20% |

| 2019 7-Year Issue | -1.89% | 0.15% | 0.28% |

| 2019 12-Year Issue | 0.10% | 0.57% | 0.32% |

| 2021 13-Year Issue | 0.25% | 0.46% | 0.23% |

| 2024 6-Year Issue | -0.21% | 0.46% | 0.25% |

Equities

NASI settled 0.85% higher while NSE 20, NSE 25 and NSE 10 settled 0.42%, 0.33% and 0.77% lower compared to the previous week, bringing the year-to-date performance to 25.57%, 22.86%, 31.18% and 33.37% respectively. Market capitalization gained 0.85% from the previous week to close at KES 1.81 trillion, recording a year-to-date increase of 25.82%. The performance was driven by gains recorded by large-cap stocks such as Safaricom and Stanbic of 4.10% and 1.43%. This was however weighed down by losses recorded by EABL, KCB and Equity of 4.70%, 3.84% and 1.16% respectively.

The Banking sector had shares worth KES 170.6M transacted which accounted for 14.55% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 321M transacted which represented 27.39% and Safaricom, with shares worth KES 589M transacted, represented 50.21% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Bamburi | 91.67% | 17.45% |

| Liberty | 100.00% | 16.62% |

| Flame Tree | -5.26% | 12.50% |

| Scangroup | 12.39% | 11.87% |

| Williamson Tea | 4.93% | 10.25% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 175.00% | -18.52% |

| Sanlam | -4.33% | -11.42% |

| Kakuzi | 3.18% | -9.61% |

| Olympia | -12.84% | -9.24% |

| Sameer | 0.88% | -8.40% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 7.25 | 2.89 | -60.19% |

| Derivatives Contracts | 39.00 | 5.00 | -87.18% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 23.19% | -0.37% |

| Dow Jones Industrial Average (DJI) | 12.22% | -2.20% |

| FTSE 100 (FTSE) | 6.83% | -1.31% |

| STOXX Europe 600 | 8.42% | -1.18% |

| Shanghai Composite (SSEC) | 11.39% | 1.17% |

| MSCI Emerging Markets Index | 10.71% | -1.80% |

| MSCI World Index | 17.40% | -0.86% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 3.30% | 1.03% |

| JSE All Share | 13.83% | -0.28% |

| NSE All Share (NGSE) | 30.87% | 1.41% |

| DSEI (Tanzania) | 23.03% | 0.73% |

| ALSIUG (Uganda) | 32.03% | 2.22% |

Global and Continental Markets

The US stock market closed the week in the red zone, weighed down by losses in the technology, consumer services and consumer goods sectors.

European stock markets closed the week on a downward trajectory, as investors assessed the latest batch of corporate earnings. Notably shares of Mercedes-Benz and Vinci, major European firms, declined sharply after reporting lower-than-expected earnings.

Asian stock markets closed the week on a positive note, boosted by China’s central bank’s decision to introduce a new liquidity tool to support the economy. The People’s Bank of China (PBoC) will conduct monthly outright reverse repo operations to inject liquidity into the banking system.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 3.60% and 3.86% higher at $71.16 and $75.88 respectively. Gold futures prices settled 0.80% higher at $2,751.80.

Week’s Highlights

- The IMF projects Kenya’s economic growth as measured by real GDP, to decline from 5.6% in 2023 to 5.0% in both 2024 and 2025. This makes Kenya the only middle-income African economy not expected to rebound by 2025. In contrast, the IMF forecasts moderate recoveries for South Africa and Ghana, with South Africa’s growth improving from 1.1% in 2023 to 1.5% by 2025 and Ghana’s from 3.1% in 2024 to 4.4% in 2025. Kenya’s inflation is expected to decrease to 4.5% in 2024 from 6.6% in 2023, but is anticipated to edge up again to 5.3% by the end of 2025.

- The Capital Markets Authority of Kenya approved HF Group PLC’s rights issue, enabling a major capital-raising initiative aimed at strengthening its balance sheet and supporting growth. The rights issue offers up to 1.15 billion new ordinary shares at KES 4.0 each, with a potential to raise KES 4.6 billion and an additional KES 6.0 billion through a green shoe option if demand is high. This discount-priced issuance allows eligible shareholders to acquire two new shares per existing share, with flexibility to sell or transfer rights if they choose not to participate. This move aligns with HF Group’s strategy to expand in digital services and diversify its business.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 The Nairobi Securities Exchange (NSE) is set to launch options derivatives trading on its derivatives market platform (NEXT), following approval from the Capital Markets Authority. This new offering will allow investors to trade options contracts on existing NSE futures contracts for single stocks and indices, providing them with advanced risk management tools and efficient capital deployment options. The introduction of options derivatives aims to expand Kenya’s derivatives market and offer investors greater flexibility in managing market risk.

- Hass Consult released its Land Price Index Q3’2024 Report, which indicates a strong performance in the Nairobi Metropolitan Area (NMA) land market. Nairobi suburbs experienced a 1.6% quarterly increase in land prices, driven by rising demand and infrastructure development. Satellite towns, particularly Mlolongo and Syokimau, saw significant growth due to improved accessibility and investment opportunities. However, areas like Kilimani and Ongata Rongai experienced slower growth.

- The People’s Bank of China (PBoC) lowered key lending rates to new lows during its October fixing. The one-year and five-year Loan Prime Rates (LPRs) were reduced by 25 basis points to 3.1% and 3.6% respectively. This move, along with other recent stimulus measures, including support for the property sector and measures to boost consumption, aims to revitalise China’s slowing economy. The PBoC signaled further monetary easing, including potential cuts to the reserve requirement ratio for commercial banks.

- The HCOB Eurozone Composite PMI increased to 49.7 in October from 49.6 in September, slightly below market forecasts of 49.8. Growth in the services sector and the downturn in manufacturing both eased. Production slowed as demand weakened, with new orders declining for the fifth consecutive month. Businesses responded to reduced workloads by cutting employment at the sharpest rate in nearly four years and business confidence fell to its lowest in 11 months. Input costs rose at their slowest pace since November 2020, with output price inflation also easing to a 44-month low. Germany and France were significant contributors to the overall downturn, with notable declines in business activity.

- The S&P Global US Composite PMI edged to 54.3 in October 2024, from 54.0 in September. This was primarily driven by expansion in the service sector, while manufacturing output contracted for the third consecutive month. Employment declined slightly, reflecting uncertainty leading up to the presidential election. However, business confidence improved, as businesses anticipate more stability following the election. Additionally, inflationary pressures eased, with input costs and output prices rising at a slower pace.

Get future reports

Please provide your details below to get future reports: