Foreign Exchange Reserves

The usable foreign exchange reserves increased by 2.31% to USD 8,491 million (4.4 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling slightly depreciated against the Dollar, but appreciated against the Sterling Pound and the Euro to exchange at KES 129.21, KES 168.25 and KES 140.05 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -15.81% | -0.19% |

| Euro | -19.35% | -0.88% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 12.19% to 11.91%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.19% | 11.91% |

| Interbank volume (billion) | 34.12 | 44.03 |

| Commercial banks’ excess reserves (billion) | 33.00 | 46.30 |

Fixed Income

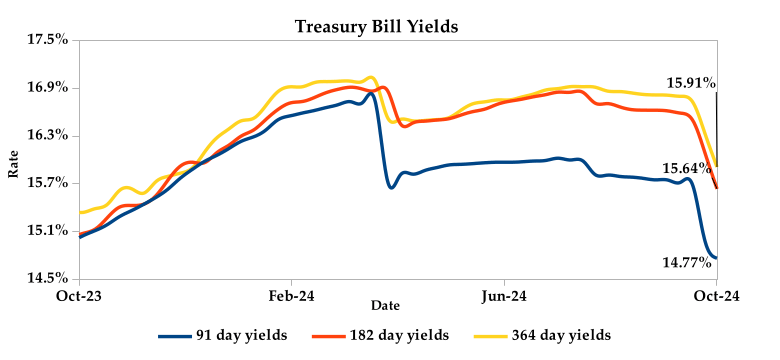

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 337.22% from 304.32% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 434.25%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 341.93% and 293.70% respectively. The acceptance rate increased by 0.11% to close the week at 42.70%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 124.39% from KES 15.35 billion in the previous week to KES 34.44 billion. Total bond deals increased by 22.76% from 479 in the previous week to 588.

In the primary bond market, CBK re-opened FXD1/2022/010 bond with a coupon rate of 13.49% targeting to raise KES 15 billion. The issue received bids worth KES 16.50 billion, representing a subscription rate of 109.98%. Of these, KES 15.09 billion worth of bids were accepted at a weighted average rate of 16.95%.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.33% compared to the previous week, increased by 0.17% month-to-date and decreased by 0.70% year-to-date. The yield on the 10- year Eurobond for Angola remained stable while that of Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.16% | 0.29% | -0.31% |

| 2018 30-Year Issue | -0.18% | 0.16% | -0.20% |

| 2019 7-Year Issue | -2.18% | -0.14% | -0.69% |

| 2019 12-Year Issue | -0.21% | 0.26% | -0.25% |

| 2021 13-Year Issue | 0.02% | 0.23% | -0.27% |

| 2024 6-Year Issue | -0.46% | 0.21% | -0.25% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 3.99%, 3.04%, 4.69% and 4.79% higher compared to the previous week, bringing the year-to-date performance to 24.52%, 23.38%, 31.62% and 34.40% respectively. Market capitalization also gained 3.98% from the previous week to close at KES 1.79 trillion, recording a year-to-date increase of 24.75%. The performance was driven by gains recorded by large-cap stocks such as EABL, KCB, Standard Chartered and ABSA of 16.07%, 6.55%, 6.27% and 4.93% respectively.

The Banking sector had shares worth KES 594.6M transacted which accounted for 73.94% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 36.2M transacted which represented 4.50% and Safaricom, with shares worth KES 116M transacted, represented 14.48% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Orchards | 258.97% | 58.91% |

| Car & General | -9.60% | 18.95% |

| EA Breweries | 60.00% | 16.07% |

| I&M Holdings | 57.31% | 14.38% |

| Standard Group | -20.16% | 12.36% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 237.50% | -40.59% |

| Eveready | -11.02% | -11.76% |

| Eveready | 0.46% | -10.61% |

| Unga | -8.90% | -6.40% |

| Flame Tree | -15.79% | -5.88% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 6.17 | 7.25 | 17.40% |

| Derivatives Contracts | 16.00 | 39.00 | 143.75% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 23.65% | 0.85% |

| Dow Jones Industrial Average (DJI) | 14.74% | 1.94% |

| FTSE 100 (FTSE) | 8.25% | 1.27% |

| STOXX Europe 600 | 9.71% | 0.58% |

| Shanghai Composite (SSEC) | 10.10% | 1.36% |

| MSCI Emerging Markets Index | 12.73% | -0.38% |

| MSCI World Index | 18.42% | 0.57% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 2.24% | 0.22% |

| JSE All Share | 14.16% | 1.47% |

| NSE All Share (NGSE) | 29.06% | 0.48% |

| DSEI (Tanzania) | 23.03% | 1.20% |

| ALSIUG (Uganda) | 32.03% | 2.57% |

Global and Continental Markets

The US stock market closed the week with a surge, driven by strong Netflix earnings and robust retail sales data. Additionally, lower than expected jobless claims further boosted the market sentiment.

European stock markets closed the week in the green zone, as investors assessed positive corporate earnings and the European Central Bank’s decision to cut interest rates.

Asian stock markets closed the week on a positive note, boosted by China’s central bank stimulus measures. The People’s Bank of China (PBOC) launched a lending program to support share buybacks and opened a swap facility to enhance market liquidity. Additionally, the PBOC hinted at potential future cuts in bank reserve requirements.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 9.09% and 7.38% lower at $68.69 and $73.06 respectively. Gold futures prices settled 2.01% higher at $2,730.00.

Week’s Highlights

- The National Treasury gazetted revenue and net expenditures data for the the third month of the FY 2024/25, ending 30th September 2024. Total revenue collected amounted to KES 590.87 billion, representing 20.25% of the original KES 2.92 trillion target. This was 18.98% lower than the projected KES 729.30 billion for the period. Total expenditure reached KES 771.71 billion, accounting for 17.86% of the original estimate. The resulting fiscal deficit of KES 180.83 billion was financed through domestic and external borrowings of 85.32% and 14.68% respectively.

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective from 15th October 2024 to 14th November 2024. The pump price of super petrol, diesel and kerosene decreased by KES 8.18, KES 3.54 and KES 6.93 to KES 180.66 per litre, KES 168.06 per litre and KES 151.39 per litre respectively.

- The Central Bank of Kenya (CBK) authorised JPMorgan Chase Bank, the largest US bank, to establish a regional office in Kenya. The office aims to serve large multinationals that require specialised investment banking services not readily available locally. This decision aligns with JPMorgan’s 2018 announcement that the bank had formed a dedicated team to strengthen its presence and relationships in Kenya and Ghana.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 The Central Bank of Kenya (CBK) successfully migrated the Kenya Electronic Payment and Settlement System (KEPSS) to the ISO20022 Global Messaging Standard. KEPSS is Kenya’s real-time gross settlement system for processing large value domestic and regional payments. Between August 2023 and August 2024, KEPSS handled over 5.3 million transactions worth over KES 45 trillion. This aims to accelerate settlement times, streamline processing and improve liquidity management for financial institutions. Additionally, the CBK announced progress on a financial sector-wide interoperable payment solution: the Fast Payment System (FPS). FPS will enable instant transfers across all financial institutions, driving greater efficiency and promoting financial inclusion. A technical working group, formed by the CBK and industry stakeholders, has been established to develop and implement the FPS solution.

- East Africa Growth Holding (EAGH) plans to acquire 4.97% of I&M Group’s shares for KES 4.2 billion. This follows a subscription agreement approved by I&M’s board of directors. EAGH will purchase shares at KES 48.42 each, a premium to I&M’s current share price. The transaction is subject to customary conditions. EAGH is affiliated with AfricInvest, a private equity investor with interests in over 200 African companies. I&M Group is publicly listed on the Nairobi Securities Exchange with subsidiaries in Rwanda, Mauritius, Tanzania and Uganda. In March, EAGH acquired 10.13% of I&M Group’s shares from British International Investment.

- UK’s inflation eased to 1.7% in September 2024, the lowest since April 2021, from 2.2% in the previous two months and below expectations of 1.9%. This was primarily due to a sharp decline in transport costs, especially air fares and motor fuels. While housing, utilities and furniture prices also fell, food and beverage costs increased. Services inflation slowed but remained elevated. Notably, the only significant upward pressure resulted from a rise in food and non-alcoholic beverages.

- The European Central Bank (ECB) lowered its key interest rates by 25 basis points in October 2024, as expected. This follows similar moves in September and June. The decision was primarily due to an updated assessment of inflation, which is now below the ECB’s 2% target. While wage growth remains high, inflationary pressures are easing. The ECB remains committed to maintaining restrictive rates to ensure inflation returns to its medium-term goal while adopting a data-driven and flexible approach.

- China’s economy grew 4.6% year-on-year in Q3 2024, down from 4.7% in Q2. This marked the slowest growth since Q1 2023, amid persistent property weakness, weak domestic demand, deflation risks and trade tensions. Despite Beijing’s stimulus efforts, economic recovery remains a concern. While industrial output and retail sales improved in September, exports and imports remained sluggish. For the first nine months, the economy grew 4.8%, compared to the government’s target of 5%.

Get future reports

Please provide your details below to get future reports: