Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.32% to USD 7,775 million (4.0 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated against the Sterling Pound and the Euro to exchange at KES 128.47, KES 164.03 and KES 139.00 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -18.17% | -0.82% |

| Sterling Pound | -17.92% | 0.08% |

| Euro | -19.95% | 0.10% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate marginally increasing from 13.26% to 13.28%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.26% | 13.28% |

| Interbank volume (billion) | 20.43 | 19.96 |

| Commercial banks’ excess reserves (billion) | 12.80 | 17.60 |

Fixed Income

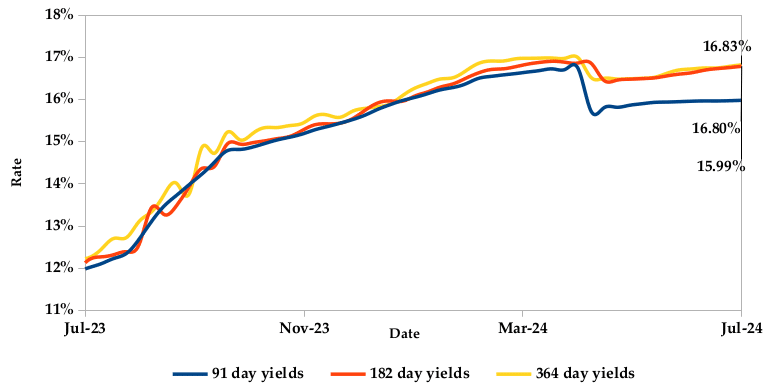

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 124.40%, from 32.04%, recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 370.10%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 94.20% and 56.32% respectively. The acceptance rate increased by 18.68% to close the week at 93.43%.

Treasury Bill Yields

T-Bonds

In the secondary bond market, there was a high demand for the week’s bond offers. Bond turnover slightly increased by 3.60%, from KES 33.23 billion in the previous week to KES 34.42 billion. Total bond deals however, decreased by 16.53% from 605 in the previous week to 505.

In the primary bond market, CBK released auction results for FXD1/2023/002 which sought to raise KES 20.0 billion. The issue received bids worth KES 487.50 million, representing a subscription rate of 2.44%. Of these, KES 486.48 million worth of bids were accepted at a weighted average rate of 17.12%.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.08% compared to the previous week, decreased by 0.19% month-to-date and increased by 0.59% year-to-date . The yields on the 10- Year Eurobonds for Angola and Zambia decreased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.34% | -0.21% | 0.01% |

| 2018 30-Year Issue | 0.63% | -0.17% | -0.02% |

| 2019 7-Year Issue | -0.26% | -0.29% | 0.11% |

| 2019 12-Year Issue | 0.87% | -0.17% | 0.09% |

| 2021 13-Year Issue | 1.24% | -0.13% | 0.11% |

| 2024 6-Year Issue | 0.73% | -0.14% | 0.18% |

Equities

NASI, NSE 25 and NSE 10 settled 0.43, 0.22%, 0.24% lower, while NSE 20 settled 0.19% higher compared to the previous week, bringing the year-to-date performance to 18.54%, 19.58%, 22.33% and 10.00% respectively. Market capitalization also declined by 0.43% from the previous week to close at KES 1.76 trillion, recording a year-to-date increase of 18.54%. The performance was driven by losses recorded by large-cap stocks such as KCB, Stanbic, Co- operative Bank and Standard Chartered of 3.67%, 2.99%, 2.99% and 2.02% respectively.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Longhorn | -2.90% | 11.96% |

| Nation Media | -11.03% | 7.40% |

| Bamburi | 23.89% | 6.70% |

| KPLC | 25.71% | 6.02% |

| NBV | -7.32% | 4.11% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| BK Group | -12.68% | -13.89% |

| Olympia Capital | -17.74% | -9.73% |

| Flame Tree | 4.39% | -7.03% |

| Umeme | -6.75% | -6.15% |

| Jubilee Holdings | -9.19% | -6.15% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 1.45 | 6.40 | 342.82% |

| Derivatives Contracts | 13.00 | 20.00 | 53.85% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 17.38% | 1.95% |

| Dow Jones Industrial Average (DJI) | 4.40% | 0.66% |

| FTSE 100 (FTSE) | 6.25% | 0.49% |

| STOXX Europe 600 | 7.96% | 1.01% |

| Shanghai Composite (SSEC) | -0.42% | -0.59% |

| MSCI Emerging Markets Index | 7.83% | 1.72% |

| MSCI World Index | 12.99% | 1.97% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 282.38% | -7.91% |

| JSE All Share | 6.33% | 1.03% |

| NSE All Share (NGSE) | 31.62% | -0.04% |

| DSEI (Tanzania) | 15.26% | 0.81% |

| ALSIUG (Uganda) | 17.15% | -0.81% |

US stocks posted gains during the week, led by gains in the Technology, Consumer Services and Consumer Goods sectors. Market sentiment was bolstered by data showing a slowdown in US hiring in June and an increase in the unemployment rate to its highest level since late 2021, which put downward pressure on Treasury yields and increased speculation about a potential rate cut in September.

European market closed the week an a positive note, buoyed by dovish remarks from the Fed Chair and positive U.S. economic data that strengthened expectations of an interest rate cut. Investors also kept an eye on the upcoming French legislative elections and the U.K. national elections.

Asian stocks plunged this week, following escalation of trade tensions with the European Union as the tariffs on imports took effect. The tariffs are as high as 38%, and China and the EU failed to reach a deal to lower or delay the proposed duties imposing tariffs on Chinese electric vehicles and the US restricting trade with certain Chinese firms.

Week’s Highlights

- GDP growth moderated to 5% in the first quarter of 2024 ,compared to 5.5% in the same period of 2023.This expansion was driven by strong performances in several sectors, including Agriculture, Forestry and Fishing, Real Estate, Financial and Insurance, Information and Communication, and Accommodation and Food Services. Favorable weather conditions, similar to those experienced in Q1 2023, again boosted agricultural production.

- According to the Kenya National Bureau of Statistics Q1 2024 report on Quarterly Balance of Payment and International Trade, Kenya’s current account balance widened by 18.8% from KES 110.5 billion in Q1 2023 to Kes 131.2 billion in Q1 2024, due to widening of merchandise trade deficit by 10.3% to KES 341.6 billion. The capital account balance, which includes foreign direct investments (FDIs) increased by 22.2% to a surplus of KES 8.5 billion, from a surplus of KES 6.9 billion in Q1 2023. The financial account balance recorded a 246.1% increase to a surplus of KES83.2 billion, from a deficit of KES 83.2 billion recorded in Q1 2023. This resulted to an increase in the balance of payments to a surplus of KES 33.8 billion, from a deficit of KES 127.8 billion recorded in Q1 2023.

- 5 The Stanbic Kenya PMI decreased to 47.2 in June 2024 from 51.8 in May, marking the steepest decline since November 2023. Widespread economic challenges, protests and policy uncertainty significantly impacted business activity, leading to a sharp drop in sales. Purchasing activity also fell for the first time in three months, while employment growth slowed to its weakest pace this year. Despite lower fuel costs and favorable exchange rates, input prices rose slightly due to higher product taxes. Firms responded with only a modest increase in output prices, reflecting mild cost pressures. Furthermore, business confidence weakened, with future activity expectations falling to a four-month low as economic concerns dampened firms’ optimism about future sales and output.

- Kenya finalized an agreement with the UAE that grants preferential market access for Kenyan goods, further solidifying its trade momentum following a similar deal with the European Union. This comes after a remarkable first quarter of 2024, where Kenyan exports to Asia increased by 76.4% year-on-year. This growth was fueled by a surge in shipments of tea, goat meat and jet fuel to both Saudi Arabia and the UAE.

- Peleza, a Kenyan digital verification startup, merged with US-based digital security platform, Prembly, to form the Prembly Group. This merger brings together Peleza’s deep East African experience (partnering with Uber, FedEx and others) and Prembly’s expertise in navigating digital security for emerging markets. With over 100 employees across offices in Uganda, Kenya, the US and Nigeria, the Prembly Group is positioned to deliver advanced solutions and help businesses across Africa overcome adoption hurdles.

- The Caixin China General Manufacturing PMI increased to 51.8 in June 2024 from 51.7 in May, exceeding market expectations of 51.2. This marks the eighth consecutive month of expansion in the sector, with factory output surging to a two-year high. The rise is fueled by strong new orders, which have now grown for the eleventh month straight. Additionally, purchasing activity climbed to a three-year high, leading to a further build-up of stockpiles.

- Eurozone inflation dipped slightly to 2.50% in June, down from 2.60% in May. This marks a welcome decline after a period of rising prices. However, core inflation, which excludes volatile food and energy prices, remained steady at 2.9% year-on-year.

- The HCOB Eurozone Composite PMI edged up slightly to 50.9 in June, indicating continued private sector growth but at the slowest pace in three months. While still in expansion territory above 50.0, a slowdown is evident across both services and manufacturing. The service sector’s growth moderated to 52.8 from 53.2, while manufacturing activity contracted at a faster rate, dipping to 45.8 from 47.3. This slowdown seems fueled by softening demand, with new orders declining for the first time since February.

Get future reports

Please provide your details below to get future reports: