Foreign Exchange Reserves

The usable foreign exchange reserves declined by 1.98% to USD 6,989 million (3.70 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 131.73, KES 167.80 and KES 143.03 respectively. The observed depreciation against the Dollar is attributed to increase demand from importers.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -16.09% | 0.76% |

| Sterling Pound | -16.04% | 1.42% |

| Euro | -17.63% | 0.77% |

Liquidity

Liquidity in the money markets slightly increased, with the average inter-bank rate decreasing from 13.51% to 13.50%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (Previous) | Week (Ending) |

|---|---|---|

| Inter-bank rate | 13.51% | 13.50% |

| Inter-bank volume (billion) | 18.44 | 22.06 |

| Commercial banks’ excess reserves (billion) | 10.90 | 19.70 |

Fixed Income

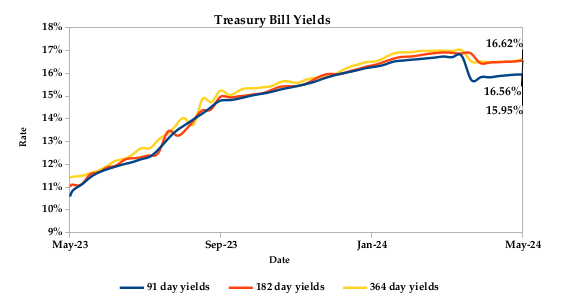

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 100.15%, down from 194.75% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 177.61%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 116.50% and 52.81% respectively. The acceptance rate increased by 0.08% to close the week at 98.66%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 22.28%, from KES 28.88 billion in the previous week to KES 22.45 billion. Total bond deals increased by 17.26% from 701 in the previous week to 822.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.50% compared to the previous week, decreased by 0.17% month-to-date and 0.45% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | MTD Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.85% | -0.18% | 0.50% |

| 2018 30-Year Issue | -0.17% | -0.04% | 0.38% |

| 2019 7-Year Issue | -1.23% | -0.21% | 0.67% |

| 2019 12-Year Issue | -0.24% | -0.22% | 0.50% |

| 2021 13-Year Issue | 0.20% | -0.15% | 0.48% |

| 2024 6-Year Issue | -0.44% | -0.21% | 0.46% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 2.34%, 0.73%, 2.74% and 4.02% higher, compared to the previous week, bringing the year-to-date performance to 22.97%, 13.83%, 24.52% and 29.20% respectively. Market capitalization also gained 2.35% from the previous week to close at KES 1.77 trillion, recording a year-to-date increase of 22.97%. The performance was driven by gains recorded by large-cap stocks such as KCB, NCBA, Co-operative bank and ABSA of 10.36%, 7.18%, 4.31% and 4.25% respectively. This was however weighed down by loss recorded by Stanbic of 12.83%.

The Banking sector had shares worth KES 1Bn transacted which accounted for 51.89% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 104M transacted which represented 4.67% and Safaricom, with shares worth KES 916.6M transacted, represented 41.08% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | -11.50% | 12.03% |

| KCB | 60.14% | 10.36% |

| NSE | 11.72% | 8.00% |

| ScanGroup | 6.42% | 7.91% |

| NCBA | 5.66% | 7.18% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Stanbic | 2.59% | -12.83% |

| Flame Tree | -4.39% | -9.17% |

| Nation Media | -0.74% | -7.95% |

| Boc Kenya | 2.13% | -5.63% |

| Eveready | 4.24% | -3.91% |

Alternative Investments

| Week (previous) | Week (ending)% | % change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.60 | 4.69 | 80.45% |

| Derivatives Contracts | 19.00 | 31.00 | 63.16% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 11.85% | 0.03% |

| Dow Jones Industrial Average (DJI) | 3.59% | -2.34% |

| FTSE 100 (FTSE) | 7.72% | -1.22% |

| STOXX Europe 600 | 8.79% | -0.45% |

| Shanghai Composite (SSEC) | 4.27% | -2.07% |

| MSCI Emerging Markets Index | 5.69% | -1.53% |

| MSCI World Index | 9.24% | -0.30% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 256.80% | 7.59% |

| JSE All Share | 4.92% | -0.64% |

| NSE All Share (NGSE) | 28.45% | -0.52% |

| DSEI(Tanzania) | 16.26% | 15.37% |

| ALSIUG (Uganda) | 23.88% | 2.62% |

Global and Continental Markets

The US stock markets was volatile during the week, as investors assessed lower-than-expected consumer inflation expectations. However, the rally fizzled as concerns about the Fed keeping interest rates high persisted. This concern stemmed from recent hawkish Fed minutes and strong PMI data, which indicated ongoing business activity and potential inflationary pressures.

European stocks ended the week in the red zone, fueled by concerns that central banks, particularly the Fed, would hold off on aggressive rate cuts as previously expected. Strong economic data in Europe added to these worries, raising doubts about the European Central Bank making cuts beyond June.

Asian stock markets closed the week on a downward trajectory, as investors grappled with escalating trade tensions with the US and rising interest rate concerns, dampening investor sentiment.

Week’s Highlights

The Kenya National Bureau of Statistics (KNBS) released the FY’2023 Economic Survey Report, below are the major economic highlights:

- Kenya’s GDP increased to 5.6% in 2023 from a revised growth of 4.9% in 2022. This was primarily attributed to resilient service sectors and a resurgent agricultural sector. Favorable weather conditions throughout the year boosted agriculture’s rebound significantly. Meanwhile, service industries such as finance and insurance, real estate, transportation, information and communication, and hospitality all witnessed strong growth.

- Kenya’s current account deficit narrowed significantly in FY’2023, falling 13% to KES 603.7 billion from KES 694.2 billion in 2022. This improvement stemmed from two main factors. First, the value of imports grew at a slower pace compared to exports, leading to a slight contraction in the merchandise trade deficit. Second, income received from abroad, such as remittances, surged by 27.2%, contributing to a larger surplus in the secondary income balance.

- Kenya’s balance of payments (BoP) improved in FY’2023, with the overall deficit decreasing by 46.4% to KES 134.8 billion compared to the previous year. This positive trend was driven by a narrower current account deficit by 13% and a slight increase in the capital account balance. However, a decline in net financial inflows by 21.2% partially offset these gains.

- Kenya’s external debt rose in 2023, with the total stock reaching KES 6.1 trillion by December, a 30.3% increase from the previous year. This growth was primarily attributed to a significant surge in multilateral debt, which increased by 38.3% to KES 3.1 trillion. Commercial bank loans also contributed, rising 28.2% to KES 1.6 trillion.

- 5 The President’s state visit to the US secured significant progress on security cooperation. Kenya will receive 150 armored vehicles and 16 helicopters for enhanced security operations, building on over $230 million in US security support over the past four years. Additionally, the visit fostered broader economic collaboration, including US backing for the IMF’s program in Kenya and potential multi-sectoral investments, alongside discussions for a US- Kenya trade deal by end of the year. This visit strengthens Kenya’s security posture and broadens the partnership with the US across economic and security spheres.

- Tech giant Microsoft and G42, an Emirati AI company, announced a $1 billion investment in Kenya’s digital ecosystem, marking the largest private-sector digital investment in the nation’s history. This collaborative effort, supported by both USA and UAE governments, will establish a state-of-the-art green data center, foster local-language AI development in Swahili and English, launch an East Africa Innovation Lab to empower entrepreneurs and expand internet access through fiber optic infrastructure. The initiative also prioritizes digital safety and security with the creation of a “trusted data zone,” paving way for a cloud-first government approach and a more digitally connected East Africa.

- The People’s Bank of China (PBoC) maintained key lending rates at the May fixing in line with market expectations, aiming to support economic recovery following mixed April data that showed steady industrial output, low unemployment and weak retail sales. The 1-year loan prime rate (LPR), a key benchmark for businesses and households, remained at 3.45% and the 5-year LPR, used for mortgages, was maintained at 3.95%. The PBOC is also taking additional measures to support the economy, such as stabilizing the Yuan, lowering down payments for home buyers, easing property purchase rules and encouraging local governments to buy unsold homes for conversion.

- UK inflation decreased to 2.3% in April 2024 from 3.2% in March, above the market forecast of 2.1%. This marks the lowest decline since July 2021 and was primarily attributed to decreasing gas and electricity prices by 37.5% and 21% respectively, due to a recent energy price cap reduction. Food and recreation costs saw slower price increases of 2.9% and 4.4% respectively. However, motor fuel prices, restaurants and hotels, and miscellaneous goods and services increased by 3.3%, 6.0% and 0.3% respectively. On a monthly basis, consumer prices rose slightly by 0.3%.

- The S&P Global UK Composite PMI decreased to 52.8 in May from 54.1 in April and below market expectations of 54, indicating a slight slowdown in private sector growth. This was driven by a strong performance in manufacturing, with the PMI rising to 51.3. The services sector also increased to 52.9, albeit at a slower pace than April. Furthermore, new orders and exports continued to expand, suggesting healthy demand. Businesses also reported the slowest rise in average selling prices in over three years. Notably, respondents indicated reduced labor cost pressures after the National Living Wage increase, particularly within the services sector.

Get future reports

Please provide your details below to get future reports: