Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,130 million (3.80 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0- months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated against the Sterling Pound and the Euro to exchange at KES 131.73, KES 165.46 and KES 141.93 respectively. The observed appreciation against the Dollar is attributed to the increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -16.73% | -0.40% |

| Sterling Pound | -17.21% | 1.03% |

| Euro | -18.27% | 0.58% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.75% to 13.51%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (Previous) | Week (Ending) |

|---|---|---|

| Inter-bank rate | 13.75% | 13.51% |

| Inter-bank volume (billion) | 15.64 | 18.44 |

| Commercial banks’ excess reserves (billion) | 11.80 | 10.90 |

Fixed Income

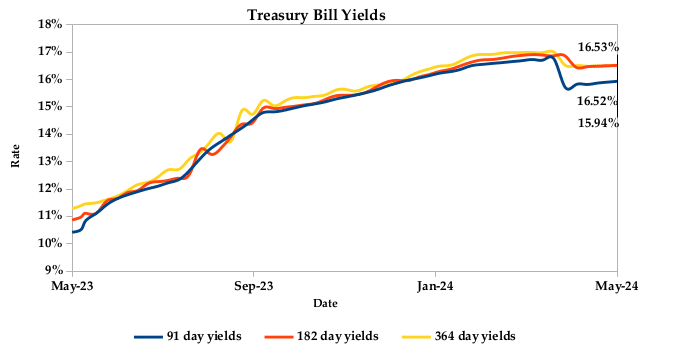

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 194.75%, down from 223.57% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 325.35%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 180.44% and 156.83% respectively. The acceptance rate increased by 6.77% to close the week at 98.58%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 17.81%, from KES 24.52 billion in the previous week to KES 28.88 billion. Total bond deals increased by 53.06% from 458 in the previous week to 701. In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.20% compared to the previous week, 0.67% month-to-date and 0.95% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | MTD Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.35% | -0.68% | -0.16% |

| 2018 30-Year Issue | -0.55% | -0.43% | -0.11% |

| 2019 7-Year Issue | -1.90% | -0.88% | -0.34% |

| 2019 12-Year Issue | -0.74% | -0.72% | -0.23% |

| 2021 13-Year Issue | -0.28% | -0.64% | -0.18% |

| 2024 6-Year Issue | -0.90% | -0.67% | -0.16% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 3.78%, 2.70%, 3.65% and 4.13% higher, compared to the previous week, bringing the year-to-date performance to 20.16%, 13.00%, 21.20% and 24.20% respectively. Market capitalization also gained 3.78% from the previous week to close at KES 1.73 trillion, recording a year-to-date increase of 20.15%. The performance was driven by gains recorded by large-cap stocks such as Equity, KCB, Safaricom and Co-operative of 7.04%, 5.99%, 5.45% and 5.37% respectively.

The Banking sector had shares worth KES 532M transacted which accounted for 60.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 97.9M transacted which represented 11.00% and Safaricom, with shares worth KES 183.8M transacted, represented 20.86% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| HF Group | 26.96% | 17.11% |

| NBV | -3.25% | 13.33% |

| Uchumi | 5.56% | 11.76% |

| BOC Kenya | 8.23% | 9.91% |

| Home Africa | 12.82% | 9.68% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Standard Group | 26.36% | -9.52% |

| Britam | 3.50% | -8.59% |

| TP Serena | -7.69% | 7.41% |

| Transcentury | 7.69% | -6.67% |

| Car General | -6.00% | -6.19% |

Alternative Investments

| Week (previous) | Week (ending)% | % change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.47 | 1.43 | -58.71% |

| Derivatives Contracts | 23.00 | 10.00 | -56.52% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 10.12% | 1.85% |

| Dow Jones Industrial Average (DJI) | 4.77% | 2.16% |

| FTSE 100 (FTSE) | 9.22% | 2.68% |

| STOXX Europe 600 | 8.83% | 3.01% |

| Shanghai Composite (SSEC) | 6.53% | 0.48% |

| MSCI Emerging Markets Index | 4.58% | 0.96% |

| MSCI World Index | 7.91% | 1.74% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 230.17%- | -4.27% |

| JSE All Share | 4.10% | 2.68% |

| NSE All Share (NGSE) | 29.27% | -1.36% |

| DSEI(Tanzania) | 1.16% | 0.00% |

| ALSIUG (Uganda) | 17.24% | -1.54% |

The US stock market posted gains during the week, as investors digested positive jobless claims data that rekindled hopes for interest rate cuts by the Federal Reserve. The European stock markets closed the week on an upward trajectory, buoyed by strong corporate earnings. Investor focus now shifts to Germany’s April inflation data, seen as crucial for the ECB’s upcoming interest rate decisions. Asian stock markets closed the week on a positive note, fueled by gains in the tech and consumer sectors. Additionally, investor sentiment was boosted by positive consumer prices data from China.

Week’s Highlights

The Treasury announced the Finance Bill 2024 and the following were the key tax

proposals:

- VAT: Removes exemptions for financial services and some goods and services; expands VAT to include betting, gaming and the lottery.

- Excise Duty: Increases rates for betting, gaming, the lottery from 12.5% to 20% and some telecommunication services from 20% to 15%.

- Tax Deductions: Allows deductions for social security and housing contributions.

- Reduced Export and Investment Promotion Levy from max 17.5% to 3.0%.

- Export Incentives: Reduces a levy on exports and expands to specific new goods, such as vodka and certain milk products.

- Digital Taxation: Introduces a withholding tax on digital content monetization of 5% for residents and 20% for non-residents.

- Family Trust Taxation: Income from registered family trusts will be taxable.

- The New Motor Vehicle Tax: introduces a new 2.5% tax on the value of a car (minimum KES 5,000, maximum KES 100,000). Exemptions apply to specific vehicles, like ambulances and government vehicles.

- The Stanbic Bank Kenya PMI increased to 50.1 in April 2024 from 49.7 in March, signaling a stabilization in operating conditions. While new orders and output levels remained steady, employment, purchases and inventories all grew, suggesting a rise in existing workloads and positive business expectations. Additionally, average input costs fell for the first time in nearly four years, driven by declines in the wholesale and retail sectors. The 12-month outlook for production continues to exhibit a robust recovery from February’s survey record low, with optimism reaching a 13-month high. This upswing is primarily driven by growth expectations in the services sector.

- The Capital Markets Authority (CMA) introduced regulations for Alternative Investment Funds (AIFs), targeting institutional and high net-worth investors with a minimum initial investment of KES 1 million. AIFs pool investments from 2 to 100 individuals in various structures: debt, equity, hedge funds, property and infrastructure. These regulations aim to ensure AIFs meet strict governance standards while protecting investors through minimum investment thresholds and transparency requirements. AIFs offer diversification benefits, potentially mitigating risks during economic downturns.

- The Nairobi Securities Exchange (NSE) has listed the KES 3 billion Linzi Sukuk on its

Unquoted Securities Platform (USP). This Shariah-compliant Islamic security, structured as a

residential lease-based security, has a 15-year maturity and offers an internal rate of return

(IRR) of 11.13%. The proceeds from the Sukuk will be used to finance the construction of

affordable institutional housing, directly supporting the government’s affordable housing

agenda. - The Bank of England (BoE) kept its interest rate at 5.25%, the highest level since 2008, but signaled a potential shift in policy. Despite meeting market expectations, two policymakers voted for a rate cut, hinting at a dovish turn. This aligns with the BoE’s revised economic outlook, which forecasts inflation returning to its 2% target and growth picking up in Q1 The BoE even projects further rate cuts by year-end, reaching 3.75%. While inflation risks persist particularly due to geopolitical factors, the central bank emphasizes its data- driven approach, suggesting a potential easing cycle on the horizon.

- China’s trade surplus narrowed to $72.4 billion in April 2024 from $86.5 billion in April 2023, falling short of expectations of $76.7 billion. This decline is primarily due to the 8.4% surge in imports compared to the modest growth in exports of 1.5%. However, the trade gap with the US widened to $27.2 billion in April. Looking at the year-to-date figures, China maintains a surplus of $255.7 billion, with exports edging up slightly and imports showing a moderate increase.

Get future reports

Please provide your details below to get future reports: