Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,833 million (3.67 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and the Euro but appreciated against the Sterling Pound to exchange at KES 149.79, KES 158.11 and KES 182.30 respectively. The observed depreciation against the Dollar is attributed to a high demand from energy and commodity importers.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 21.36% | 0.44% |

| Sterling Pound | 22.57% | -0.47% |

| Euro | 20.09% | 0.03 |

Liquidity

Liquidity in the money markets tightened, with the average interbank rate increasing from 12.31% to 12.62%, as tax remittances more than offset government payments. Remittance inflows totaled $340.40 million in September 2023, a 3.92% decrease from $354.30 million in August 2023, and a 7.1% rise from $318.0 million in September 2022. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.31% | 12.62% |

| Interbank volume (billion) | 28.33 | 23.52 |

| Commercial banks’ excess reserves (billion) | 17.50 | 18.90 |

Fixed Income

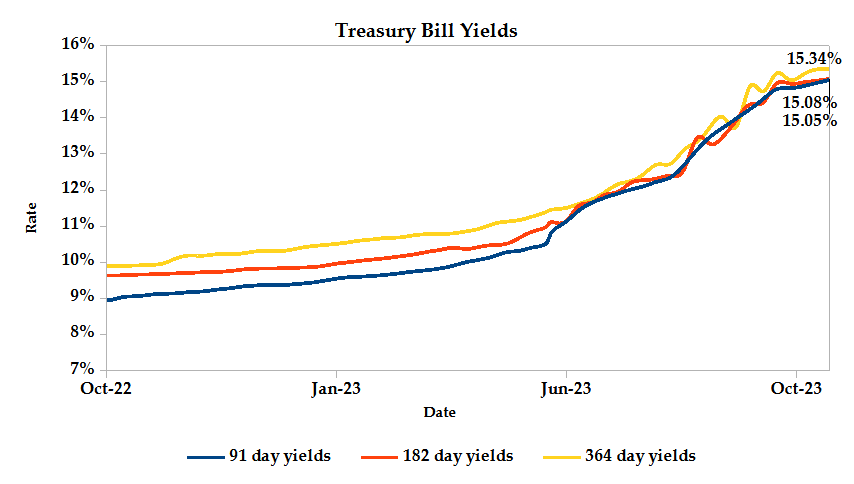

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate recorded as 123.39%, down from 180.15% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 588.90% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 37.90% and 22.67% respectively. The acceptance rate decreased by 2.11% to close the week at 92.69%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 162.04% from KES 3.76 billion in the previous week to KES 9.85 billion. Total bond deals decreased by 0.28% from 359 in the previous week to 358.

In the primary bond market, CBK issued a new 6.5-year infrastructure bond, IFB1/2023/6.5, seeking KES 50 billion. The new bond coupon rate will be market-determined. The sale runs from 20/10/2023 to 08/11/2023.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.75% compared to the previous week, 0.03% month-to-date loss and a 3.17% year-to-date gain. The yields on the 10-year Eurobonds for Angola increased while that for Zambia declined. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 3.62% | -2.45% | 1.61% |

| 2018 10-Year Issue | 3.66% | 0.69% | 0.60% |

| 2018 30-Year Issue | 1.97% | 0.22% | 0.36% |

| 2019 7-Year Issue | 4.13% | 0.47% | 0.91% |

| 2019 12-Year Issue | 2.56% | 0.47% | 0.51% |

| 2021 13-Year Issue | 3.06% | 0.44% | 0.49% |

Equities

NASI and NSE 20 settled 0.21% and 0.14% lower while NSE 25 and NSE 10 settled 0.27% and 0.86% higher compared to the previous week, bringing the year-to-date performance to -26.83%, -11.06%, -21.59% and -4.25% respectively. Market capitalization lost 0.21% from the previous week to close at KES 1.46 trillion, recording a year-to-date decline of 26.63%. The performance was driven by losses recorded by large-cap stocks such as Stanbic, KCB and Standard Chartered of 5.22%, 4.78% and 2.14% respectively. These were however boosted by gains recorded by large-cap stocks such as EABL, Equity and NCBA 4.96%, 2.19% and 2.18% respectively.

The Banking sector had shares worth KES 296M transacted which accounted for 48.67% of the week’s traded value, Energy & Petroleum sector had shares worth KES 20M transacted which represented 3.39% and Safaricom, with shares worth KES 270M transacted represented 44.30% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | 20.59% | 12.33% |

| New Gold | 31.18% | 12.25% |

| Olympia | 8.11% | 10.34% |

| NBV | -21.83% | 10.00% |

| Crown Paint | -10.84% | 8.19% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Express | -21.17% | -8.75% |

| Eveready | 65.28% | -8.46% |

| CIC Insurance | 4.17% | -5.66% |

| TP Serena | -9.23% | -5.60% |

| Stanbic | 6.86% | -5.22% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 0.29 | 1.39 | 373.96% |

| Derivatives Contracts | 14.00 | 39.00 | 178.57% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 10.46% | -2.39% |

| Dow Jones Industrial Average (DJI) | -0.02% | -1.61% |

| FTSE 100 (FTSE) | -2.01% | -2.60% |

| STOXX Europe 600 | -0.10% | -3.44% |

| Shanghai Composite (SSEC) | -4.28% | -3.40% |

| MSCI Emerging Markets Index | -3.84% | -2.70% |

| MSCI World Index | 7.32% | -2.48% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -1.92% | 1.13% |

| JSE All Share | -5.50% | -3.80% |

| NSE All Share (NGSE) | 29.69% | -0.42% |

| DSEI (Tanzania) | -5.83% | -0.19% |

| ALSIUG (Uganda) | -23.00% | 1.91% |

The US stock market closed the week in the red, as investors grappled with rising treasury yields and uncertainty over the Fed’s next move. Higher treasury yields make it more expensive for businesses to borrow money, resulting in lower investment and economic growth. Investors are also concerned that the Fed may raise interest rates too aggressively in an effort to combat inflation, which could lead to a recession.

European stock market closed the week on a downward trajectory, primarily due to concerns over the ongoing Israeli-Palestinian conflict, rising government bond yields and a disappointing earnings season start, as evidenced by declines in industrial metals, miners, travel and leisure shares, retailers and oil majors.

Asian stock markets closed the week in the red as well, as investors weighed concerns over China’s struggling property sector and data showing Japan’s headline inflation rate falling to a one-year low of 3% in September.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 0.44% and 1.40% higher at $88.08 and $92.16 respectively. Gold futures prices settled 2.72% higher at $1994.40.

Week’s Highlights

- The Kenya Revenue Authority (KRA) has achieved consistent growth in revenue collection, with a notable 20.9% increase in the first quarter of the 2023/2024 financial year to KES 537 billion. The expenses surpassed revenue collections by KES 208 billion, signalling a fiscal deficit of 39% which was financed through external and internal borrowing by 28% and 72% respectively.

- Kenya and China signed a Memorandum of Understanding (MoU) to improve Kenya’s electrical grid. The deal is expected to help Kenya plan, design and modernize its power generation, transmission and distribution lines, as well as its substations. It also supports the development of renewable energy and energy storage to boost Kenya’s energy sufficiency. This will enhance Kenya’s energy security and reliability and reduce its reliance on imported oil and gas.

- The government approved four Universal Health Coverage (UHC) bills into law, including the Social Health Insurance Bill, which abolishes the National Health Insurance Fund (NHIF) and creates three new funds: a Primary Health Care Fund, a Social Health Insurance Fund, and a Chronic Illness and Emergency Fund. The Social Health Insurance Bill also mandates that all Kenyans employed in the formal sector make a monthly contribution of 2.75% of their salary, capped at a minimum of Ksh. 300 and a maximum of Ksh. 5,000. The bill aims to make healthcare more affordable and accessible and to improve the quality of healthcare services.

- Safaricom has acquired the entire share capital of M-Pesa Holding Company (MPHCL) from Vodafone International Holdings. This gives Safaricom control over MPCHL, which holds M-Pesa customer funds in trust for the benefit of M-Pesa customers in Kenya. The acquisition is expected to boost Safaricom’s cash flows and allow the company to earn interest income by investing part of the M-Pesa war chest in short-term securities.

- Microsoft and Flutterwave have announced a five-year strategic technology partnership. Under the terms of the partnership, Flutterwave will develop its next-generation platform on Microsoft Azure, with the goal of fast-tracking payment innovation and boosting the growth of small businesses across the continent. The newly constructed platform is expected to give Flutterwave a scalable and reliable foundation to support its growth and innovation. Additionally, it will grant Flutterwave access to Microsoft’s cloud computing technologies, such as machine learning (ML) and artificial intelligence (AI).

- The People’s Bank of China (PBoC) kept the interest rate unchanged at 2.50% and injected a net CNY 289 billion of fresh funds into the banking system, the largest medium-term liquidity injection since 2020. The move comes amid growing signs that the Chinese economy is stabilizing, with better-than-expected Q3 GDP figures and solid data in September for retail sales, industrial output and the jobless rate. The PboC decreased the medium-term policy rate twice since June in an effort to stimulate credit demand.

- UK inflation held steady at 6.7% in September 2023, slightly defying market expectations of 6.6%. A smaller decline in energy expenses as a result of a monthly increase in motor fuel prices was offset by a slower price increase in food and drinks, furniture and household products. The core inflation rate, which excludes volatile items such as energy and food, fell to 6.1% in September, its lowest point since January. However, both the headline and core inflation rates remained above the Bank of England’s target of 2%. The Consumer Price Index (CPI) increased by 0.5% in September compared to the previous month, the biggest increase since May. This was largely due to a rise in the cost of food and recreation.

- The Chinese economy grew 4.9% year-on-year in the third quarter of 2023, beating market expectations of 4.4%. Primarily driven by continued stimulus from Beijing, which offset the impact of a prolonged real estate crisis and sluggish trade. Retail sales increased for the ninth month in a row in September, while industrial output growth remained at its best level since April. The jobless rate decreased to a 22-month low of 5%, while fixed investment grew in the first nine months of 2023. Exports fell at a slower pace, partly because of a peak shipping season for Christmas products.

Get future reports

Please provide your details below to get future reports: